2024-07-22 06:19:00

www.techspot.com

In brief: Nvidia’s dominance of the AI hardware market has seen it become the third-largest company in the world, with a market cap of $2.9 trillion. Things are looking rosy for Team Green, but SK Group and Korea Chamber of Commerce and Industry (KCCI) Chairman Chey Tae-won warns that Nvidia could still fall spectacularly.

Speaking to attendees at the 47th KCCI Jeju Forum (via The Korea Times), Chey had some warnings for the AI industry and Nvidia. He pointed out that while Jensen Huang’s company is generating huge amounts of money from its AI hardware, that will change if the billions of dollars that firms are investing into the area don’t eventually turn into profits.

Venture capital firm Sequoia Capital recently estimated that the tech industry needs to make $600 billion annually just to break even on its AI investments. As the cost of training AI LLMs increases, that figure will keep going up.

Companies might believe that people are happy to pay more for their AI technologies, but a recent survey with over 20,000 participants found that 84% were unwilling to pay extra just because something had AI capabilities/features.

Chey compared the generative AI boom to the California Gold Rush in the mid-19th century. Nvidia is like the pickaxe and jeans sellers that made a fortune from selling their items to the miners who migrated to California looking to make their fortune. “When there was no more gold, the sellers became unable to sell pickaxes,” Chey said.

There was also a warning that if Nvidia competitors such as AMD and Arm start selling AI chips of comparable quality to Nvidia’s for a lower price, then “Nvidia’s model may fall apart.” Chey noted that Microsoft, Google, and Amazon could decide to abandon Nvidia hardware if they believe the cost savings outweigh the benefits.

Nvidia briefly became the most valuable company in the world last month when its market cap reached $3.34 trillion, pushing it above Microsoft and Apple.

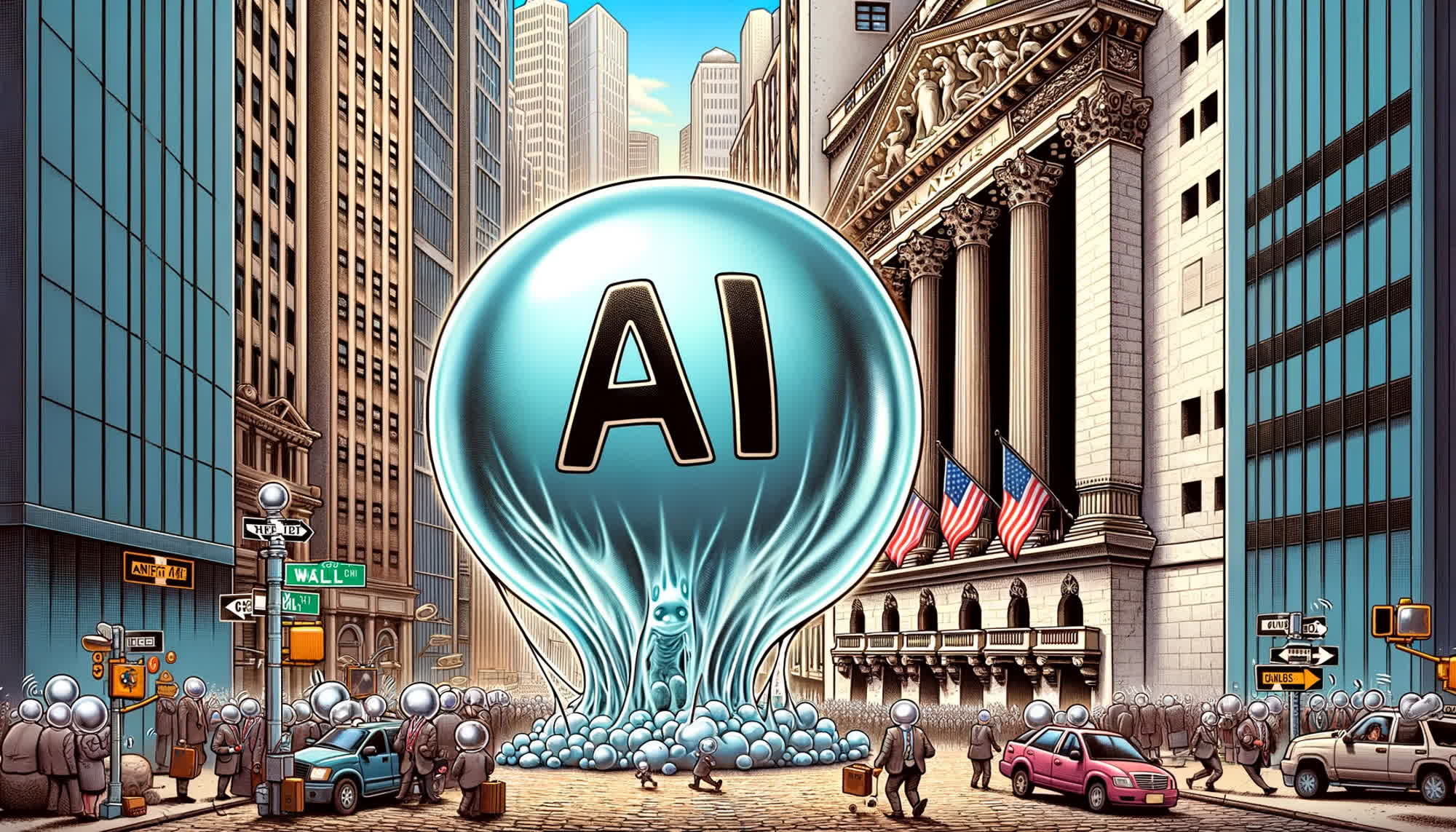

Many analysts have warned that the amount of money being poured into the AI industry might lead to a dot-com-style bubble that inevitably bursts, causing a market-wide disaster. Such an event would likely be a long way off, so Nvidia will likely be more concerned about competitors selling rival products for less right now. At least Nvidia might put more focus on its gaming segment if an AI market crash did occur.

![Five Nights At Freddy's – Walkthrough [1] DON'T WATCH AT NIGHT!! (+Download)](https://techcratic.com/wp-content/uploads/2024/11/1731599476_maxresdefault-360x180.jpg)