Kayla Zhu

2024-07-30 16:06:48

www.visualcapitalist.com

The Concentration of S&P 500 Sectors

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The S&P 500 index is made up of 11 sectors of varying sizes, including Information Technology, Financials, Consumer Discretionary, Energy, and more.

Within the index, each sector is weighted differently. The Information Technology sector makes up almost a third of the index at 32.4%, while Financials make up 12.4%.

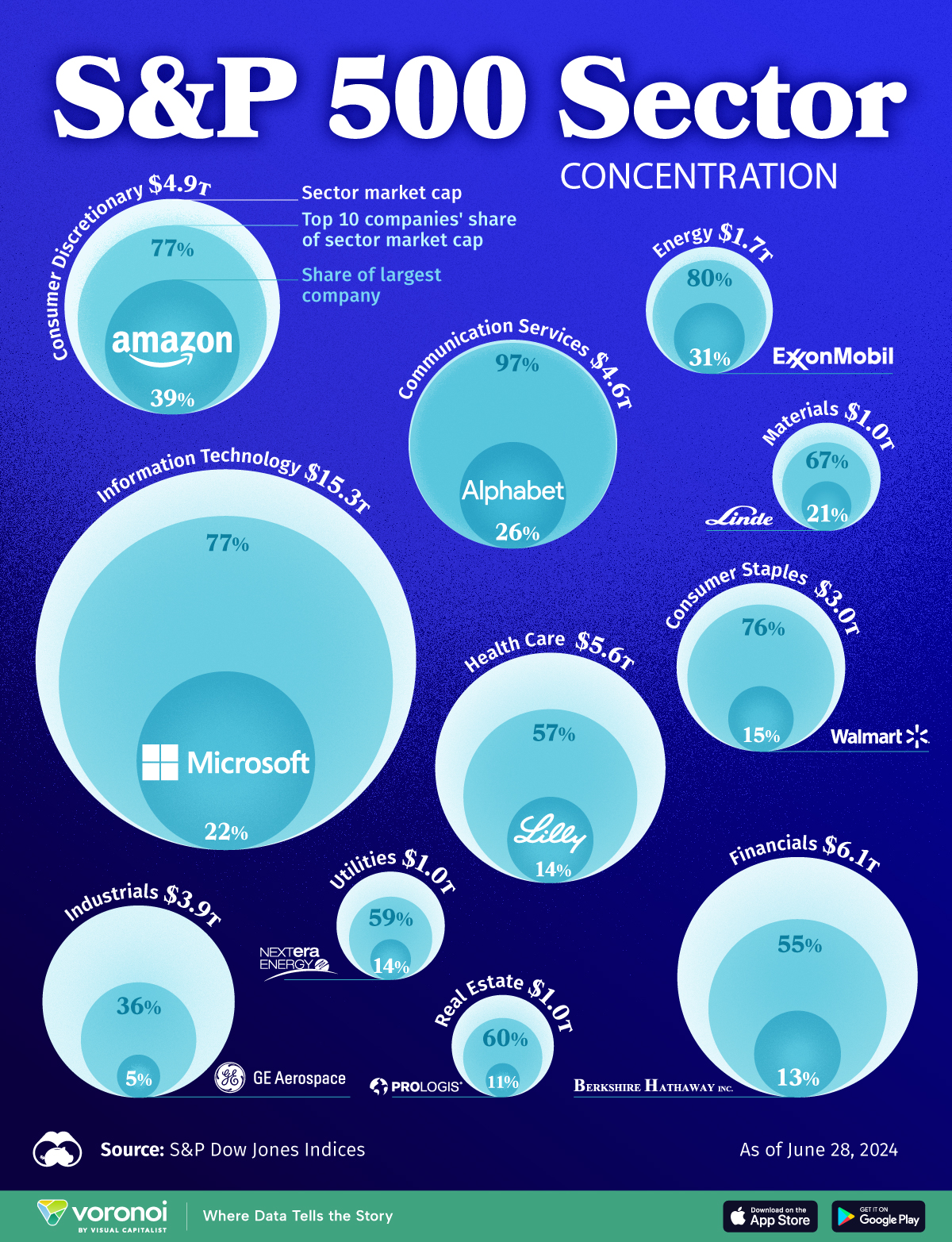

This graphic visualizes the 11 sectors of the S&P 500, each sector’s total market capitalization, the top 10 companies’ share of their sector’s market cap, and the largest company in each sector.

The data comes from S&P Dow Jones Indices and is updated as of June 28, 2024.

Communications Services is the Most Concentrated

The top 10 companies account for 97% of the Communication Services sector’s total market cap, making this sector the most concentrated of the S&P 500. Alphabet, the multinational technology conglomerate holding company that owns Google, makes up 26% of the sector’s market cap.

Here’s a look at how many companies are in each sector, and what share the top 10 companies make of the sector’s market cap:

| Sector | Market Cap | Number of Companies in Sector | Top 10 Share of Sector’s Market Cap |

|---|---|---|---|

| Communication Services | $4.6T | 22 | 96.5% |

| Energy | $1.7T | 22 | 79.5% |

| Information Technology | $15.3T | 67 | 77.3% |

| Consumer Discretionary | $4.9T | 52 | 76.6% |

| Consumer Staples | $3.0T | 38 | 75.7% |

| Materials | $1.0T | 28 | 67.1% |

| Real Estate | $1.1T | 31 | 60.2% |

| Utilities | $1.0T | 31 | 59.3% |

| Health Care | $5.6T | 63 | 56.6% |

| Financials | $6.1T | 71 | 54.7% |

| Industrials | $3.9T | 78 | 35.7% |

Next, here is the largest company in each sector, and their share of that sector’s market cap:

| Sector | Market Cap | Largest Constituent | Share of largest constituent in sector |

|---|---|---|---|

| Consumer Discretionary | $4.9T | Amazon | 38.8% |

| Energy | $1.7T | Exxon Mobil | 30.9% |

| Communication Services | $4.6T | Alphabet | 25.8% |

| Information Technology | $15.3T | Microsoft | 22.3% |

| Materials | $1.0T | Linde plc | 21.4% |

| Consumer Staples | $3.0T | Walmart | 14.7% |

| Utilities | $1.0T | NextEra Energy | 14.0% |

| Health Care | $5.6T | Eli Lilly and Company | 13.5% |

| Financials | $6.1T | Berkshire Hathaway | 12.9% |

| Real Estate | $1.1T | Prologis | 10.5% |

| Industrials | $3.9T | GE Aerospace | 4.7% |

In general, sectors home to big tech companies like Amazon, Alphabet, and Microsoft, are among the most concentrated. These big tech stocks have also seen outsized earnings growth in 2023 and 2024, compared to the median of the entire S&P 500.

The S&P 500 has seen record levels of concentration, with the 10 largest stocks now accounting for a third of the index’s market value.

Among all sectors, Amazon makes up the greatest share of their sector, accounting for a staggering 39% of the Consumer Discretionary sector’s total market cap. On June 26, 2024, Amazon reached $2 trillion in market cap for the first time ever, joining the likes of Nvidia, Apple, and Alphabet.

The post Charted: The Largest Company in Every Sector of the S&P 500 appeared first on Visual Capitalist.

![Why This SMALL SOLDIERS GAME Is Worth The Money [Hypercharge: Unboxed]](https://techcratic.com/wp-content/uploads/2024/11/1732654274_maxresdefault-360x180.jpg)