andy.chalk@pcgamer.com (Andy Chalk)

2024-09-05 13:49:11

www.pcgamer.com

The launch of Star Wars Outlaws should have been a triumph for Ubisoft—a milestone moment heralding a turnaround in the company’s fortunes. But on the financial front at least, it hasn’t really worked out that way. Outlaws has been generally well received by critics, but sales don’t appear to be meeting initial expectations, and instead of seeing a surge Ubisoft’s share price has tumbled following the game’s release to its lowest mark since 2014.

Ubisoft was banking heavily on Star Wars Outlaws, saying in its most recent financial report that gameplay previews were “not only praised by players and critics alike but also highlighted the cutting-edge capabilities of our game engines.”

“As we progress through FY25, all our efforts are focused on successfully launching our promising new releases and positioning them as long-lasting value drivers for Ubisoft while continuing the transformation of our organization,” Ubisoft CEO Yves Guillemot said. “We are excited about the future and confident in the sustained progress of our turnaround throughout the year.”

But a Reuters report says sales of Star Wars Outlaws are “sluggish,” quoting JP Morgan analyst Daniel Kerven as saying that the game “has struggled to meet our sales expectations despite positive critical reviews.” Kerven also lowered his sales expectations for Star Wars Outlaws through the end of March 2025 from 7.5 million units to 5.5 million.

I’ve been around long enough that I still have a hard time envisioning 5.5 million copies sold as any sort of failure, but such is the way of the world these days. Cyberpunk 2077, by way of comparison, had sold 25 million copies as of October 2023; more recently, Helldivers 2 surpassed 12 million copies sold in just three months, while Black Myth: Wukong blasted to 10 million units sales in a week. Star Wars Outlaws is clearly not a flop, but neither is it running with the big dogs.

Investors seem very disappointed about Star Wars Outlaws’ sales numbers and let Ubisoft stock crash.Shares lost over 10% combined in the last 2 days, so the company just slipped to under €2B in market cap in Paris.Ubisoft is almost at a 10-year low. pic.twitter.com/pxpicUl8CzSeptember 3, 2024

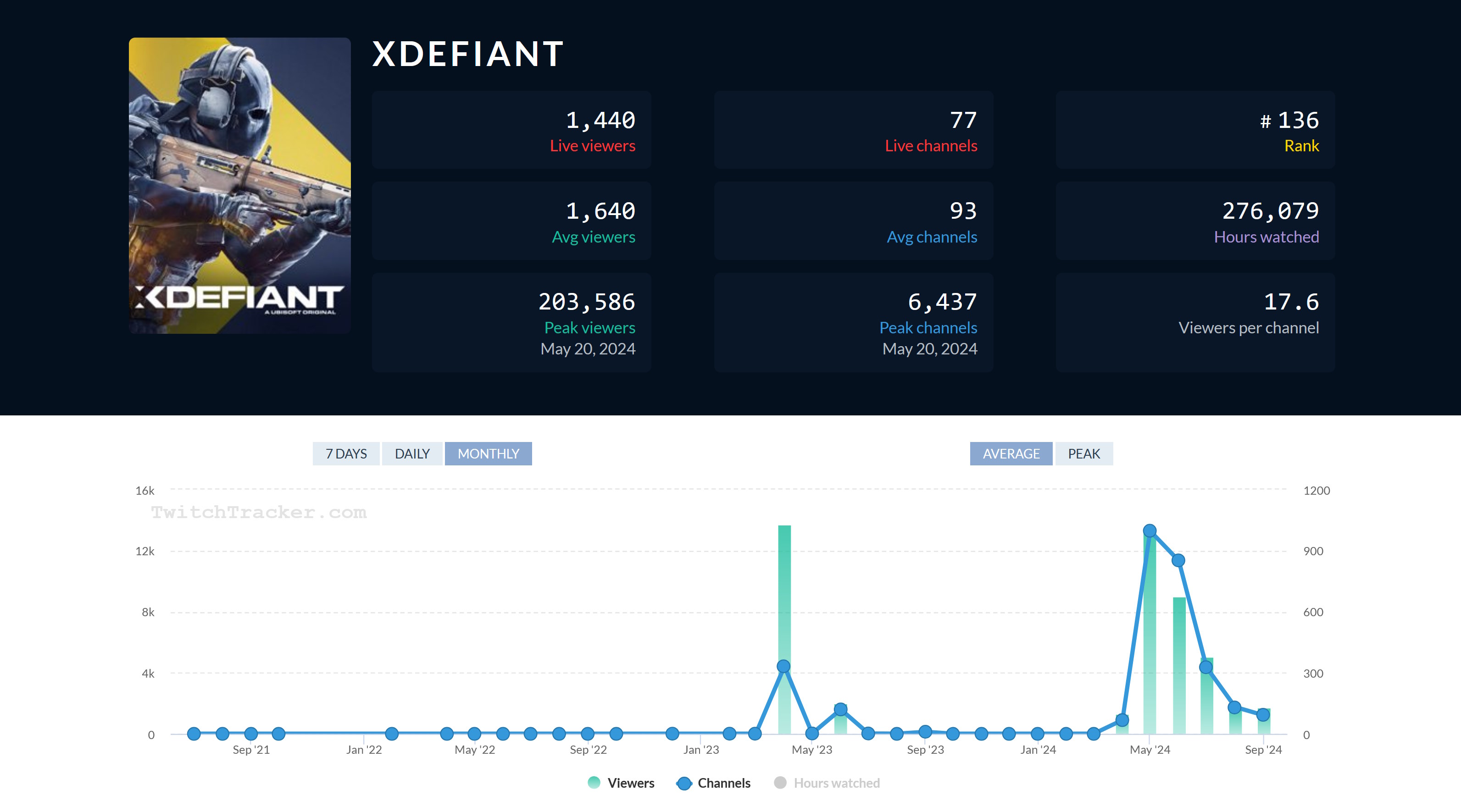

Star Wars Outlaws isn’t entirely to blame for Ubisoft’s troubles. The company’s share price has been falling since early 2021, from a high of €85 ($94) to just €15 ($16), where it sits today. That’s been driven by years of difficulties including cancellations of numerous in-development games, struggles to complete high-profile projects, and tepid reactions to games that it does manage to release. Midcap Partners analyst Charles-Louis Planade cited XDefiant in the Reuters report as one recent example of a Ubisoft game failing to find an audience: Following a strong launch driven by positive word of mouth, Planade said interest in the game has not held up. XDefiant’s viewership numbers on Twitch have also fallen off dramatically: According to TwitchTracker, viewers have slumped from a high of more than 203,000 in May to just 1,440 right now.

2020 also saw allegations of widespread sexual misconduct and harassment at the company, sparking an investigation and promise of a “structural shift” to address workplace toxicity. That resulted in the resignation or removal of multiple executives at the company, including Serge Hascoët, Tommy François, vice president Maxime Beland, managing director of Ubisoft’s Canadian studios Yannis Mallat, and global head of human resources Cécile Cornet—but not, notably, Guillemot, who pointed the finger at other employees he said had “betrayed the trust” he placed in them. Guillemot remains at the head of Ubisoft.

Ubisoft has also made bad bets on broader technology within the gaming world. Its early NFT dabbling in Ghost Recon Breakpoint was a bust (although it’s not ready to give up on the idea of “digital ownership” just yet—somewhat ironic for a company that also says people should get comfortable with the idea of not owning their games) and earlier this year it announced a slowdown on VR game development following disappointing sales of Assassins’ Creed Nexus.

The net result is a company that’s not in a great place. Seeking Alpha analyst Oliver Rodzianko said in August that Ubisoft’s valuation “reflects skepticism due to historical underperformance and modest revenue projections,” although he also believes the company was overvalued when its share price was riding high between 2017 and 2022.

Whatever the case, it’s clear the performance of Star Wars Outlaws isn’t going to do much to return Ubisoft to those lofty heights. Assassin’s Creed Shadows has the potential to be a major hit but with no major releases locked in for its 2025 year beyond that, it seems unlikely that a Ubisoft bounceback is going to happen anytime soon.

Support Techcratic

If you find value in Techcratic’s insights and articles, consider supporting us with Bitcoin. Your support helps me, as a solo operator, continue delivering high-quality content while managing all the technical aspects, from server maintenance to blog writing, future updates, and improvements. Support Innovation! Thank you.

Bitcoin Address:

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge

Please verify this address before sending funds.

Bitcoin QR Code

Simply scan the QR code below to support Techcratic.

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![Teenage Mutant Ninja Turtles – Season 3, Volume 1: Alien Invasion, Ways of the Warrior [DVD]](https://techcratic.com/wp-content/uploads/2024/11/518165SCXGL-340x180.jpg)