Jenna Ross

2024-10-17 12:23:00

www.visualcapitalist.com

Ten Years of AI Venture Capital Deals and Exits

Globally, AI startups have raised more than $650 billion in venture capital in the last decade. But how has the industry grown and changed over time?

For this graphic, we partnered with Fasken to explore the change in AI venture capital deal and exit values, along with how these changes have impacted potential investor returns.

Global Changes in AI Venture Capital

According to data from Pitchbook, average deal and exit values for AI venture capital grew significantly from 2013 to 2021.

But over the last couple of years, average deal values decreased followed by a slight uptick in 2023. Average exit values have also been dropping.

| Year | Avg Deal Value | Deal % Change | Avg Exit Value | Exit % Change |

|---|---|---|---|---|

| 2013 | $4.8M | N/A | $92.9M | N/A |

| 2014 | $7.8M | 64.0% | $36.4M | -60.8% |

| 2015 | $6.6M | -15.6% | $31.5M | -13.4% |

| 2016 | $7.3M | 10.1% | $119.0M | 278.2% |

| 2017 | $7.2M | -1.8% | $77.8M | -34.7% |

| 2018 | $9.9M | 38.6% | $138.4M | 77.9% |

| 2019 | $8.9M | -10.0% | $346.4M | 150.3% |

| 2020 | $10.6M | 18.3% | $197.4M | -43.0% |

| 2021 | $15.0M | 42.1% | $386.7M | 95.9% |

| 2022 | $10.9M | -27.3% | $102.3M | -73.6% |

| 2023 | $11.4M | 4.2% | $48.0M | -53.1% |

Despite recent declines, the sector’s frequent growth up to 2021 highlights its investment appeal and capacity for strong returns.

AI’s Investment Potential

In order to estimate AI venture capital returns, we assumed a six-year holding period. This is based on the fact that, in the U.S., the average length of time between an initial venture capital investment and an IPO is nearly six years. The average duration of a business cycle is also six years, meaning that this holding period would typically capture a full market cycle.

| Holding Period | Six-Year Return |

|---|---|

| 2013–2019 | 7,140% |

| 2014–2020 | 2,416% |

| 2015–2021 | 5,740% |

| 2016–2022 | 1,302% |

| 2017–2023 | 570% |

The difference between average deal values and average exit values six years later—our assumed holding period—have been volatile but substantial. Returns have been on a short-term decline since the period ending in 2021.

The recent drop means that AI venture capital firms will likely be more selective about which companies they back. In other words, firms may be looking for more high-quality investments versus a large quantity of deals. This could mean placing more focus on AI startups that have understandable technology, clear use cases, scalability, and a monetization strategy.

By being adaptable, firms can continue to find opportunities despite volatility in the sector. In the first half of 2024, AI investments drove over 60% of the growth in U.S. venture-backed company valuations.

Advice on Emerging Technology Deals

Interested in learning more about how to navigate the legal complexities of technology-related deals?

Fasken’s top-ranked Emerging Technology group has provided legal advice to Canada’s emerging technology sector for over 30 years. With deep industry knowledge and experience across all areas of emerging and high growth technology, we partner on ideas that propel us forward and transform the landscape of what’s possible.

Tomorrow starts here. Own it with us.

See how Fasken can help you get a strategic advantage in the fast-paced digital world.

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “Ten Years of AI Venture Capital Deals and Exits”;

var disqus_url = “https://www.visualcapitalist.com/sp/fsk01-ten-years-of-ai-venture-capital-deals-and-exits/”;

var disqus_identifier = “visualcapitalist.disqus.com-170387”;

-

Technology3 days ago

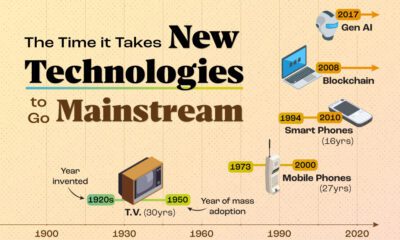

Technology3 days agoCharted: The Speed at Which New Technologies Go Mainstream

The time taken for new technologies to be invented has shortened. How has this impacted mainstream acceptance?

-

AI6 days ago

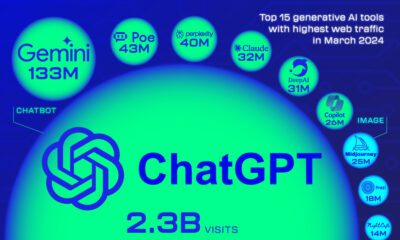

AI6 days agoRanked: The Most Popular Generative AI Tools in 2024

OpenAI’s ChatGPT recorded over 2 billion website visits in March 2024, beating out all other generative AI tools by a wide margin.

-

Technology2 months ago

Technology2 months agoCharted: Nvidia’s Quarterly Revenue (Q1 2021-Q2 2025)

Nvidia beat Wall Street estimates for its second-quarter revenue for fiscal 2025, signalling that the AI boom is far from slowing down.

-

AI2 months ago

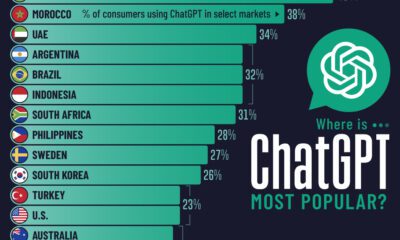

AI2 months agoRanked: Countries That Use ChatGPT the Most

Now that the initial newness has faded, which places get the most use of ChatGPT? A BCG survey has answers.

-

Technology2 months ago

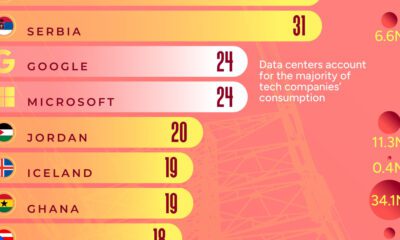

Technology2 months agoCharted: Big Tech Uses More Electricity Than Entire Countries

The AI revolution is demanding more electricity and Big Tech’s consumption is outpacing entire countries.

-

AI4 months ago

AI4 months agoRanked: The 20 Biggest Tech Companies by Market Cap

In total, the 20 biggest tech companies are worth over $20 trillion—nearly 18% of the stock market value globally.

The post Ten Years of AI Venture Capital Deals and Exits appeared first on Visual Capitalist.

Support Techcratic

If you find value in Techcratic’s insights and articles, consider supporting us with Bitcoin. Your support helps me, as a solo operator, continue delivering high-quality content while managing all the technical aspects, from server maintenance to blog writing, future updates, and improvements. Support Innovation! Thank you.

Bitcoin Address:

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge

Please verify this address before sending funds.

Bitcoin QR Code

Simply scan the QR code below to support Techcratic.

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![Friends: The Complete Series (4K UltraHD) [4K UHD]](https://techcratic.com/wp-content/uploads/2024/11/71zFLJVDUeL._SL1500_-360x180.jpg)

![#UFO FLEET | MUFON CASE # 106156 [MUST SEE] Louisiana](https://techcratic.com/wp-content/uploads/2024/11/1732148641_maxresdefault-360x180.jpg)