Jenna Ross

2024-10-18 13:35:00

www.visualcapitalist.com

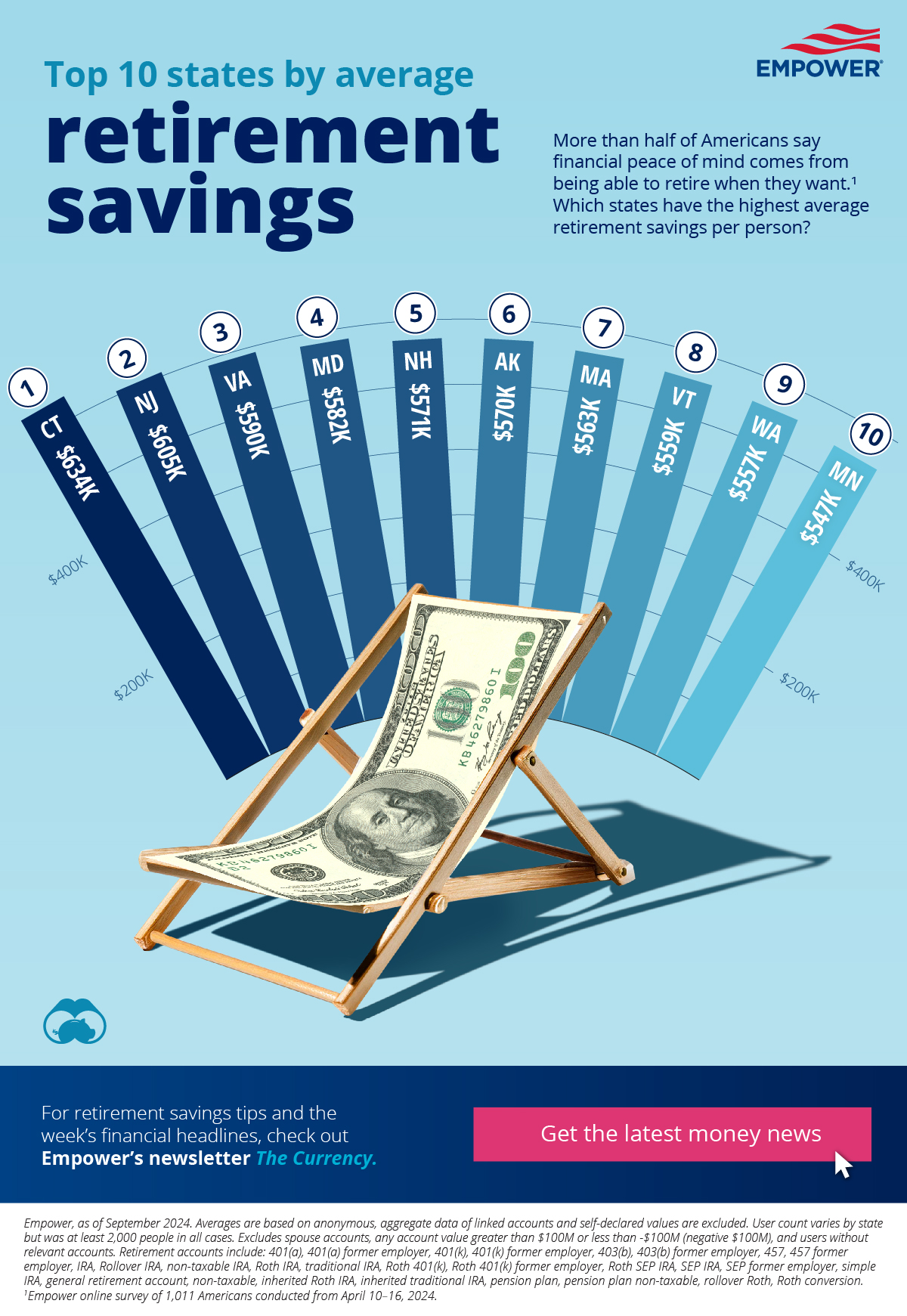

Ranked: The top 10 states by average retirement savings

Across all states, Americans have saved $498,000 on average for retirement. Which states have residents with the highest average retirement savings?

Using anonymized data from over two million Empower Personal Dashboard users, we explore these geographic trends.

users, we explore these geographic trends.

States with the highest average retirement savings

Many Americans are racing against the clock when it comes to financial goals: half think they’re running out of time to save for retirement, even though 44% say they started putting money away early enough. Another 43% wish they could go back in time to start saving sooner.

People may be further along than they think. According to Empower Personal Dashboard data, the average 401(k) balance—one key measure of overall personal savings and investments—clocks in at $293,695. For people in their 50s approaching retirement age, the number jumps to $583,231.

data, the average 401(k) balance—one key measure of overall personal savings and investments—clocks in at $293,695. For people in their 50s approaching retirement age, the number jumps to $583,231.

In the graphic, we explore the states with the highest average retirement savings per person as of September 2024. These savings are across all types of retirement accounts, such as 401(k)s, IRAs, and pension plans.

| State | Average retirement savings |

|---|---|

| CT | $634,456 |

| NJ | $605,379 |

| VA | $589,965 |

| MD | $582,087 |

| NH | $570,511 |

| AK | $569,957 |

| MA | $563,353 |

| VT | $558,522 |

| WA | $557,139 |

| MN | $547,397 |

Northeast states make up half of the top ten states by average retirement savings. The remainder are spread across the Pacific (Alaska), South (Virginia and Maryland), West (Washington), and Midwest (Minnesota). Many of these states have a high cost of living, but also have higher average after-tax household incomes.

Taxes may play a role in how much people are able to save. For instance, Alaska (#6) does not have any state income tax or sales tax, and New Hampshire (#5) has a low overall tax burden.

The ideal retirement

In an Empower survey, 51% of people say retirement is their top savings goal.

When they reach retirement, what will it look like? More than 40% of Americans spend time “dreamscrolling” their retirement by picturing their ideal age, location, and monthly spending. Around two-thirds of Americans are interested in relocating during retirement, with 16% saying they want to move to a less expensive state.

On top of cost of living, the other main factors people consider are the climate and being close to loved ones. Not surprisingly, people say they would most like to retire near the beach (32%) and in the mountains or countryside (22%). The most popular states for retirement are Florida, New York, and California.

Making a plan

No matter where you plan to retire, the first step is developing a plan to save enough for your ideal retirement.

Looking for more insights into retirement savings tips and the week’s financial headlines?

Check out Empower’s newsletter The Currency for the latest money news.

Methodology: Average retirement savings are based on anonymous, aggregate data of linked accounts and self-declared values are excluded. User count varies by state but was at least 2,000 people in all cases. Excludes spouse accounts, any account value greater than $100M or less than -$100M (negative $100M), and users without relevant accounts. Retirement accounts include: 401(a), 401(a) former employer, 401(k), 401(k) former employer, 403(b), 403(b) former employer, 457, 457 former employer, IRA, Rollover IRA, non-taxable IRA, Roth IRA, traditional IRA, Roth 401(k), Roth 401(k) former employer, Roth SEP IRA, SEP IRA, SEP former employer, simple IRA, general retirement account, non-taxable, inherited Roth IRA, inherited traditional IRA, pension plan, pension plan non-taxable, rollover Roth, Roth conversion.

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “Ranked: The Top 10 States by Average Retirement Savings”;

var disqus_url = “https://www.visualcapitalist.com/sp/emp01-ranked-the-top-10-states-by-average-retirement-savings/”;

var disqus_identifier = “visualcapitalist.disqus.com-169704”;

-

Personal Finance2 weeks ago

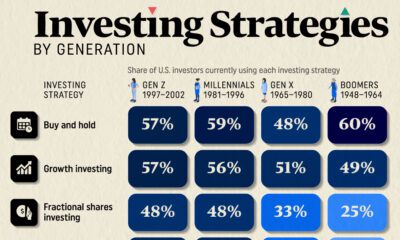

Personal Finance2 weeks agoCharted: The Most Popular Investing Strategies, by Generation

Buy and hold remains the most popular investing strategy across generations, with Baby Boomers relying on this strategy the most.

-

Demographics3 weeks ago

Demographics3 weeks agoVisualized: Global Spending Power by Generation

Gen Z is expected to add almost $9 trillion in spending globally in the next 10 years, more than any other generation.

-

Wealth1 month ago

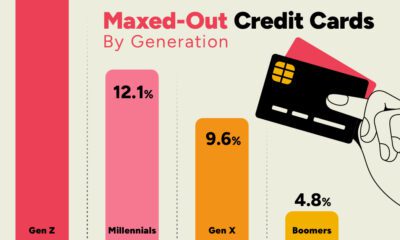

Wealth1 month agoCharted: Maxed-Out Credit Cards by Generation

Younger credit card users tend to max out their credit cards more often than older generations, with 15% of Gen Z maxing out their cards.

-

Money2 months ago

Money2 months agoRanked: The 10 Best U.S. States to Retire In

The best U.S. states to retire in are those that are affordable and warm. But #1 is from the mid-Atlantic region.

-

United States2 months ago

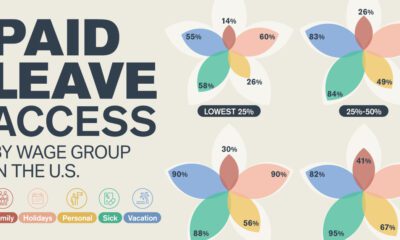

United States2 months agoAccess to Paid Time Off by Wage Group in America

The U.S. is the only nation in the OECD without a federal paid time off mandate. We show how access to paid leave varies by income…

-

Personal Finance2 months ago

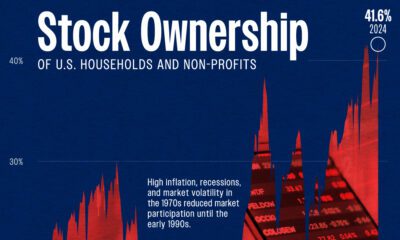

Personal Finance2 months agoCharted: American Stock Ownership Back at All-Time Highs

Today, the share of Americans’ financial assets that are invested in public stocks is near all-time highs.

The post Ranked: The Top 10 States by Average Retirement Savings appeared first on Visual Capitalist.

Support Techcratic

If you find value in Techcratic’s insights and articles, consider supporting us with Bitcoin. Your support helps me, as a solo operator, continue delivering high-quality content while managing all the technical aspects, from server maintenance to blog writing, future updates, and improvements. Support Innovation! Thank you.

Bitcoin Address:

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge

Please verify this address before sending funds.

Bitcoin QR Code

Simply scan the QR code below to support Techcratic.

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![Pioneer [Blu-ray]](https://techcratic.com/wp-content/uploads/2024/11/81EmJG9mivL._SL1500_-360x180.jpg)