Bruno Venditti

2024-10-28 10:42:00

www.visualcapitalist.com

Ranked: The Top 15 Dividend Kings in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Dividend stocks have historically shown growth, even during periods of recession.

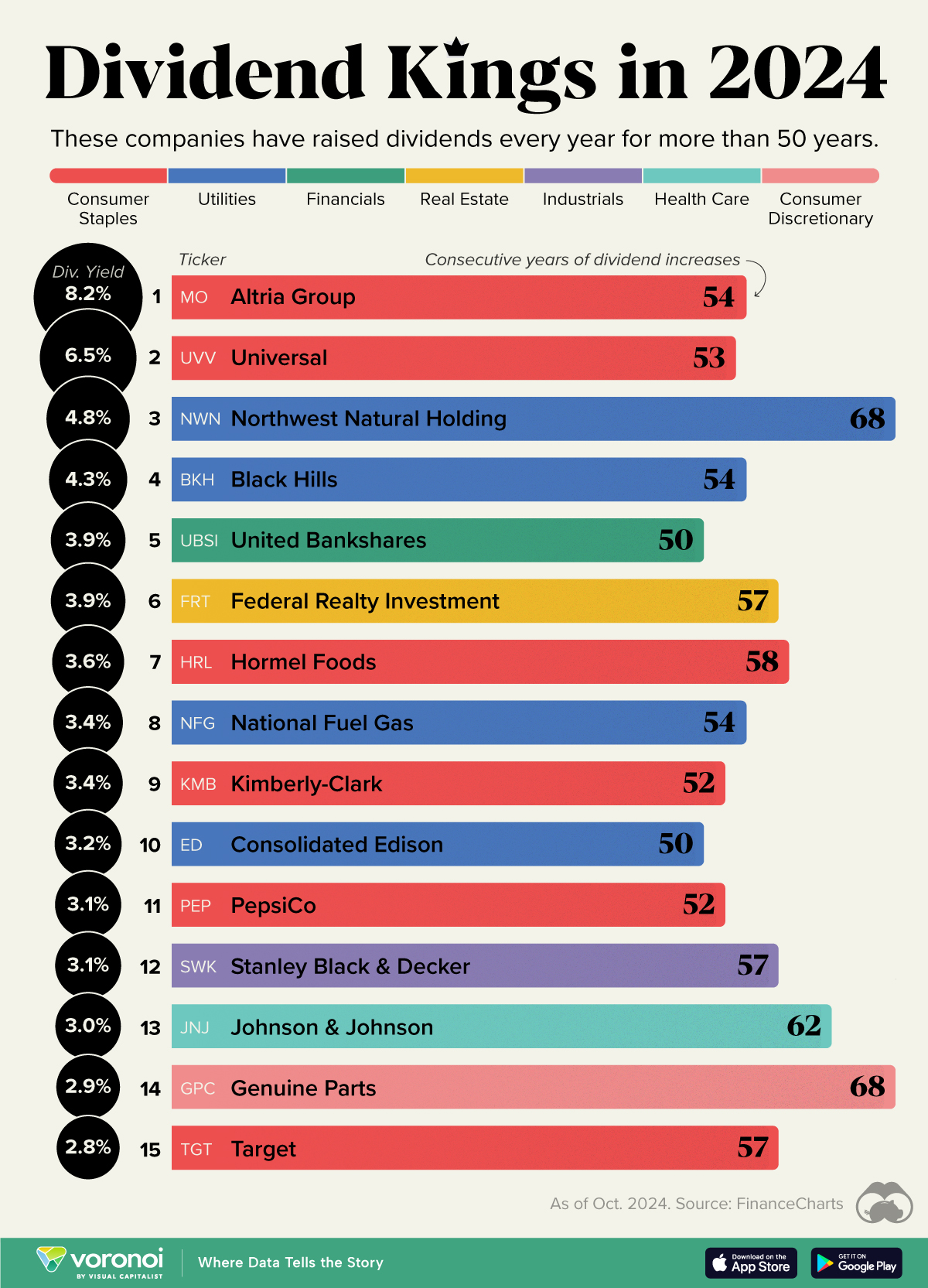

In this graphic, we showcase the top 15 ‘Dividend Kings’ in 2024, as identified by FinanceCharts, based on data available as of October 2024.

What Makes a Company a Dividend King?

A key benefit of investing in dividend-paying companies is that dividends typically grow steadily, with well-established firms often increasing payouts annually.

Dividend Kings are companies that have increased their dividends annually for more than 50 years.

Dividend Royalty

Altria Group offers the highest dividend yield at 8.18%. Formerly known as Philip Morris, the American corporation is one of the world’s largest producers and marketers of tobacco, cigarettes, and medical products for treating smoking-related illnesses.

Altria is followed by Universal, another tobacco company. The leading global supplier of leaf tobacco offers a dividend yield of 6.5%.

Northwest Natural Holding ranks third in our list. The company provides natural gas service to approximately two million people in Oregon and Southwest Washington.

| # | Name | Ticker | Sector | Market Cap | No. Years | Div. Yield |

|---|---|---|---|---|---|---|

| 1 | Altria Group | MO | Consumer Staples | $85B | 54 | 8.18% |

| 2 | Universal | UVV | Consumer Staples | $1.2B | 53 | 6.47% |

| 3 | Northwest Natural Holding | NWN | Utilities | $1.6B | 68 | 4.83% |

| 4 | Black Hills | BKH | Utilities | $4.2B | 54 | 4.27% |

| 5 | United Bankshares | UBSI | Financials | $5.1B | 50 | 3.90% |

| 6 | Federal Realty Investment | FRT | Real Estate | $9.4B | 57 | 3.89% |

| 7 | Hormel Foods | HRL | Consumer Staples | $17.1B | 58 | 3.63% |

| 8 | National Fuel Gas | NFG | Utilities | $5.6B | 54 | 3.39% |

| 9 | Kimberly-Clark | KMB | Consumer Staples | $48.9B | 52 | 3.36% |

| 10 | Consolidated Edison | ED | Utilities | $36.5B | 50 | 3.15% |

| 11 | PepsiCo | PEP | Consumer Staples | $241.2B | 52 | 3.08% |

| 12 | Stanley Black & Decker | SWK | Industrials | $16.5B | 57 | 3.06% |

| 13 | Johnson & Johnson | JNJ | Health Care | $394.4B | 62 | 3.02% |

| 14 | Genuine Parts | GPC | Consumer Discretionary | $19.5B | 68 | 2.85% |

| 15 | Target | TGT | Consumer Staples | $73.9B | 57 | 2.79% |

Genuine Parts and Northwest Natural have the longest dividend-raising streaks on our list, both at 68 years.

Learn More on the Voronoi App

To learn more about personal finances, check out this graphic on the cost of the American dream in 2024.

The post Ranked: The Top 15 Dividend Kings in 2024 appeared first on Visual Capitalist.

Support Techcratic

If you find value in Techcratic’s insights and articles, consider supporting us with Bitcoin. Your support helps me, as a solo operator, continue delivering high-quality content while managing all the technical aspects, from server maintenance to blog writing, future updates, and improvements. Support Innovation! Thank you.

Bitcoin Address:

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge

Please verify this address before sending funds.

Bitcoin QR Code

Simply scan the QR code below to support Techcratic.

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![Friends: The Complete Series (4K UltraHD) [4K UHD]](https://techcratic.com/wp-content/uploads/2024/11/71zFLJVDUeL._SL1500_-360x180.jpg)

![#UFO FLEET | MUFON CASE # 106156 [MUST SEE] Louisiana](https://techcratic.com/wp-content/uploads/2024/11/1732148641_maxresdefault-360x180.jpg)