Hassan Shittu

2025-04-22 18:36:00

cryptonews.com

Key Takeaways:

- Metaplanet’s CEO reaffirmed the company’s 10,000 BTC goal, emphasizing long-term value creation over short-term stock price swings.

- Despite recent share price declines, Metaplanet’s Bitcoin holdings and per-share yield have surged, making it Asia’s largest public BTC holder.

- The firm’s strategy shows strong conviction in Bitcoin as a treasury asset and positions it as a leader in corporate crypto adoption.

Metaplanet CEO Simon Gerovich has addressed growing concerns from shareholders over the company’s declining stock price, reaffirming the firm’s long-term strategy centered around Bitcoin (BTC) accumulation and value creation.

In a message posted Tuesday on X, Gerovich emphasized that the Japanese investment firm is committed to building lasting corporate value, rather than chasing short-term stock price movements.

“Some shareholders have expressed concerns about our share price,” Gerovich wrote. “We take these concerns seriously and would like to express our sincere gratitude to all shareholders for their continued support and belief in our vision, even in today’s volatile market environment.”

Despite Stock Slide, Metaplanet CEO Stands Firm on Bitcoin Accumulation Plan

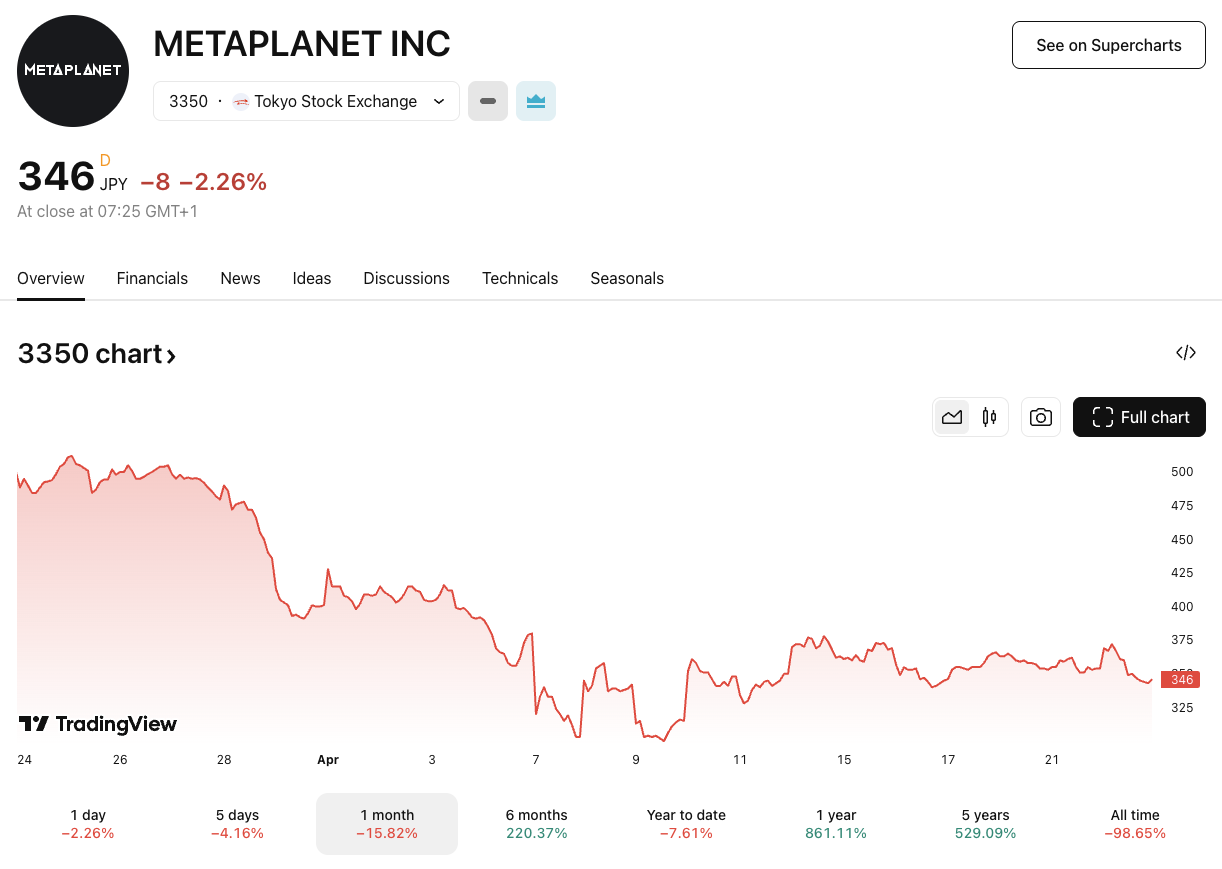

Metaplanet’s stock, listed in Tokyo, has fallen 15.8% over the past month and is down 7.6% year-to-date.

The recent dip follows a broader cooling in Bitcoin proxy stocks, including MicroStrategy, despite Bitcoin itself holding gains in 2025.

Still, Metaplanet’s stock remains up over 860% since it first launched its Bitcoin treasury strategy in April 2024.

source: TradingView.

Gerovich pinpointed that short-term fluctuations in stock price don’t necessarily reflect the company’s performance.

“We are steadily executing on a clear strategy as a Bitcoin treasury company, aiming to become one of the most valuable companies in the world in the future, and we are demonstrating our progress with clear KPIs,” he said.

Last week, Metaplanet announced the purchase of 330 BTC, worth around $28 million, bringing its total holdings to 4,855 BTC.

The firm remains on track to meet its goal of acquiring 10,000 BTC by the end of the year, despite broader market uncertainties and macroeconomic pressures.

At current market value, its BTC holdings are worth approximately $430 million, making it the largest corporate Bitcoin holder in Asia and the tenth largest globally.

According to Gerovich, the company’s growth is not only in assets but also in investor interest. “We’ve seen about a sevenfold increase in shareholders,” he said, citing growing institutional interest and inclusion in ETFs and indexes.

Metaplanet’s BTC Yield Hits 119%, Far Surpassing Quarterly Target

Metaplanet evaluates its performance using a metric called BTC Yield, which measures the change in the ratio of total Bitcoin held to fully diluted shares outstanding. Year-to-date, the firm’s BTC Yield stands at 119.3%, well above its quarterly target of 35%.

The company also tracks what it calls BTC Gain, a measure of value generated through financial strategies beyond spot purchases.

In one example, Metaplanet used cash-secured put options to acquire $67.9 million worth of Bitcoin with only $62.7 million in capital. Overall, the firm claims to have generated an additional 2,174 BTC through such methods.

“These are not future ‘hopes,’ but results that have already been achieved,” Gerovich said, noting that he himself is a major shareholder and thus closely aligned with the interests of other investors.

He added, “That is why I always prioritize shareholder interests in all my decisions. Our goal is to maximize the value of our shares and the amount of bitcoin held per share, creating value in the long term.”

While acknowledging that current market sentiment may not reflect the company’s fundamentals, Gerovich remains confident.

“Stock prices will not necessarily reflect these results in the short term, but we are confident that over the medium to long term they will converge to fundamentals,” he said. He ended by saying, “We’re just getting started.”

The post Metaplanet CEO Doubles Down: 10K BTC Goal, Yield Soars 119% appeared first on Cryptonews.

Explore new destinations with ease using the Garmin Drive 52 GPS Navigator! With over 17,988 ratings and a solid 4.4/5-star rating, this GPS system has been a top choice for travelers. Over 500+ units were bought in the past month, all for only $144.99.

This 5″ GPS navigator comes with essential driver alerts, real-time travel data, and external memory storage. The simple on-screen menus and bright, easy-to-see maps make it easy to navigate wherever you are. Plus, it’s road trip-ready with The HISTORY Channel database, featuring notable historic sites and much more to enhance your journey.

Don’t miss out—get your hands on the Garmin Drive 52 today for a smoother ride ahead! Buy Now for $144.99 on Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

|

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

|

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

|

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

Japan’s

Japan’s