Julia Wendling

2025-05-30 13:06:00

www.visualcapitalist.com

Ranked: 2025’s 10 Largest S&P 500 Stocks

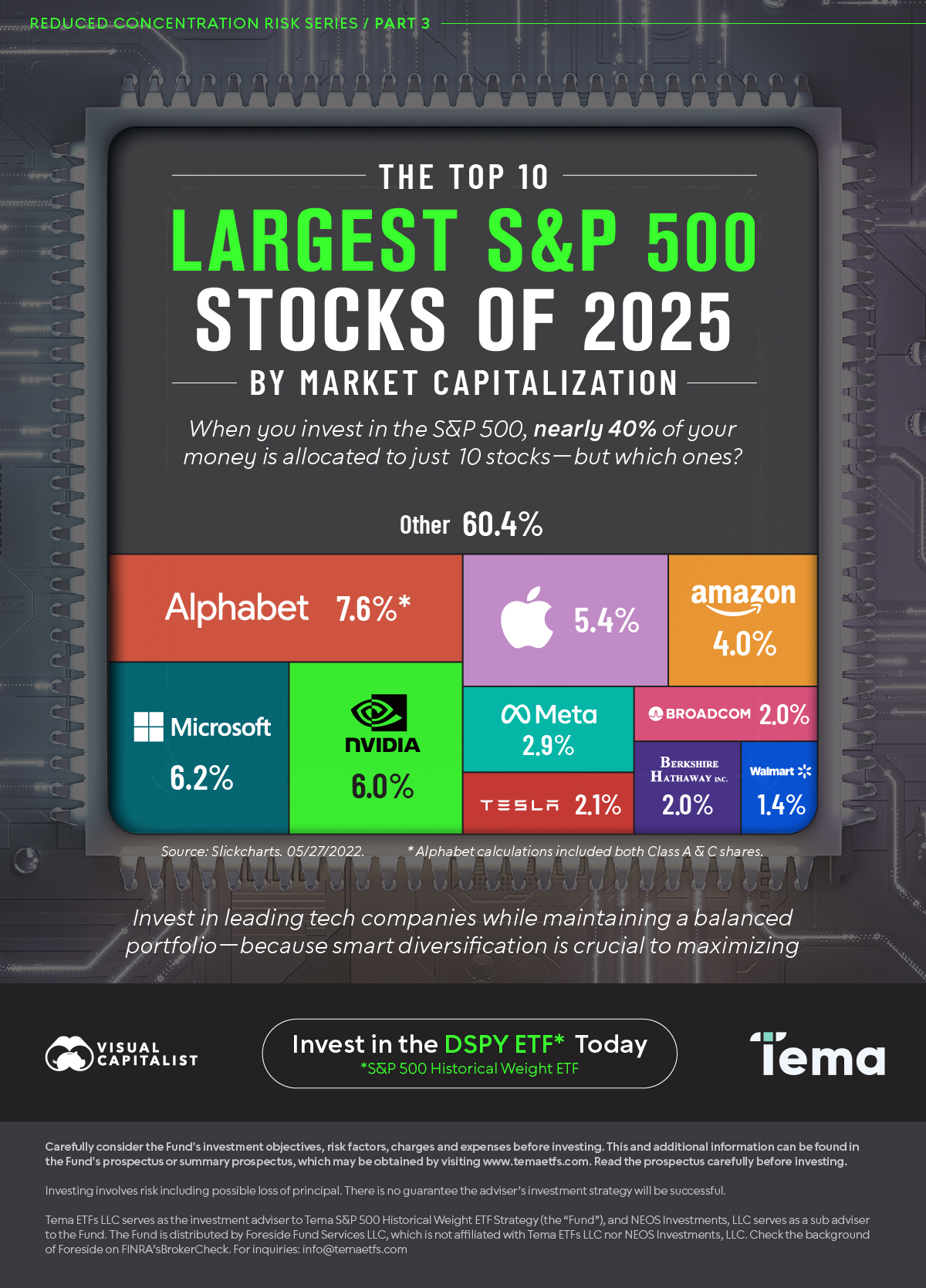

When you invest in the S&P 500, you’re gaining exposure to the 500 biggest publicly traded companies in the U.S.—but not equally. Nearly 40% of your investment is concentrated in just 10 companies. So, who’s at the top in 2025?

This graphic, sponsored by Tema, uses the latest data from SlickCharts to show the weights of the 10 largest S&P 500 stocks in 2025.

The Tech Titans Driving the Index

The biggest names in tech continue to dominate the S&P 500. Alphabet leads the pack with a 7.64% weighting, followed closely by Microsoft at 6.19%. Nvidia, which has surged on the back of AI-related demand, now commands a 5.96% share of the index.

| Rank | Company | Weight (%) |

|---|---|---|

| 1 | Alphabet | 7.64 |

| 2 | Microsoft | 6.19 |

| 3 | Nvidia | 5.96 |

| 4 | Apple | 5.42 |

| 5 | Amazon | 3.95 |

| 6 | Meta | 2.93 |

| 7 | Tesla | 2.11 |

| 8 | Broadcom | 2.01 |

| 9 | Berkshire Hathaway | 1.98 |

| 10 | Walmart | 1.42 |

| Other | 60.39 |

Rounding out the top five are Apple (5.42%) and Amazon (3.95%). This shows just how concentrated the index has become in a handful of mega-cap tech companies.

A Smarter Way to Diversify

This high concentration level means that investors betting on the S&P 500 are heavily exposed to just a few companies, mainly in tech.

While these stocks have driven much of the market’s recent gains, they also have higher volatility. Sharp price swings—especially in tech—could create anxiety for investors, even with a strong long-term outlook. That anxiety can manifest in a phenomenon called “panic selling.”

A more balanced investment approach could help smooth out those bumps, offering greater diversification and peace of mind.

The Tema S&P 500 Historical Weight ETF (DSPY) mirrors the S&P 500 while adjusting company weights to reflect their 35-year historical average levels. This strategy aims to reduce today’s high concentration risk and provide investors with a more balanced approach to investing in the S&P 500.

Disclosure

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com. Read the prospectus carefully before investing. Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk. Therefore, you should carefully consider the following risks before investing in the Fund.

Risk Information

Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Large-Capitalization

Returns on investments in securities of large companies could trail the returns on investments in securities of smaller and mid-sized companies. The securities of large-capitalization companies may also be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies may also be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes.

Calculation Methodology Risk

The Adviser relies on various sources of information to “weight-adjust” the S&P 500, including information that may be based on assumptions and estimates. Neither the Fund nor the Adviser can offer assurances that the calculation methodology or sources of information will provide accurate “weight-adjusted” S&P 500. Errors in the S&P 500 data, S&P 500 computations or the construction of the S&P 500 in accordance with its methodology, and errors in the process of “weight-adjusting” the S&P 500 may occur from time to time and may not be identified and corrected by the Index Provider or the Adviser for a period of time or at all, which may have an adverse impact on the Fund and its shareholders. “Standard & Poor’s,” “S&P”, and “S&P 500” are trademarks of Standard & Poor’s Financial Services, LLC and have been licensed for use by Tema ETFs LLC (“Tema”). Tema S&P 500® Historical Weight ETF Strategy is not sponsored, endorsed, sold, or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in Tema S&P 500® Historical Weight ETF Strategy. Tema ETFs LLC serves as the investment adviser to Tema S&P 500 Historical Weight ETF Strategy (the “Fund”), and NEOS Investments, LLC serves as a sub adviser to the Fund. The Fund is distributed by Foreside Fund Services LLC, which is not affiliated with Tema ETFs LLC nor NEOS Investments, LLC. Check the background of Foreside on FINRA’s BrokerCheck. For inquiries: info@temaetfs.com

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “Ranked: 2025’s 10 Largest S&P 500 Stocks”;

var disqus_url = “https://www.visualcapitalist.com/sp/largest-sp-500-stocks-in-2025-tema-01/”;

var disqus_identifier = “visualcapitalist.disqus.com-178228”;

-

Economy1 day ago

Economy1 day agoRanked: America’s $425B Trade Deficit by Product

See which goods drive America’s $425B trade deficit—and why they signal key opportunities for U.S. reshoring and domestic investment.

-

Markets1 week ago

Markets1 week agoVisualized: The Rising Concentration of the S&P 500

By early 2025, the top ten companies in the S&P 500 made up nearly 40%, marking a high degree of market concentration.

-

Keep your files stored safely and securely with the SanDisk 2TB Extreme Portable SSD. With over 69,505 ratings and an impressive 4.6 out of 5 stars, this product has been purchased over 8K+ times in the past month. At only $129.99, this Amazon’s Choice product is a must-have for secure file storage.

Help keep private content private with the included password protection featuring 256-bit AES hardware encryption. Order now for just $129.99 on Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

|

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

|

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

|

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![Baldur's Gate 3 Is Just A Good Game [Review]](https://techcratic.com/wp-content/uploads/2025/08/1755459069_maxresdefault-360x180.jpg)

![for 2025 Tesla Model 3 Rear Back Seat Protector [Durable Upgraded TPE] Second Row Seats…](https://techcratic.com/wp-content/uploads/2025/08/81by5xZys1L._AC_SL1500_-360x180.jpg)