Anas Hassan

2025-06-18 16:26:00

cryptonews.com

Three of China’s largest Bitcoin hardware manufacturers are establishing production facilities in the United States as President Donald Trump’s tariff policies reshape the cryptocurrency industry.

The three industry leaders, Bitmain, Canaan, and MicroBT, collectively control over 90% of the global mining rig market.

These companies are the architects of Bitcoin’s physical infrastructure, manufacturing the specialized ASIC (Application-Specific Integrated Circuit) machines that form the backbone of the world’s most valuable cryptocurrency network.

Every Bitcoin mined globally likely passes through hardware bearing Chinese engineering fingerprints.

95% Market Control Sparks “Digital Dependency Trap” and Security Risks

According to a June 18 Reuters report, these Bitcoin mining giants are establishing U.S. operations to circumvent potential tariffs. However, critics have raised security concerns about Chinese involvement in sectors spanning semiconductor manufacturing and energy infrastructure.

Guang Yang, chief technology officer at crypto technology provider Conflux Network, described the situation as extending beyond trade policy.

“The U.S.-China trade war goes beyond tariffs,” Yang stated. “It’s a strategic pivot toward ‘politically acceptable’ hardware sources.”

Bitmain, the largest of the three companies by revenue, initiated U.S. production of mining equipment in December, one month after Trump’s presidential election victory.

Canaan began trial production in the United States on April 2 to avoid tariffs following Trump’s announcement of new trade levies.

Third-ranked MicroBT announced in a statement that it is “actively implementing a localization strategy in the U.S.” to “avoid the impact of tariffs.”

$11.9B by 2028: The Market These Giants Are Fighting for

According to Frost & Sullivan’s “2024 Global Blockchain Hardware Industry White Paper,” the ASIC-based Bitcoin mining hardware market demonstrates substantial consolidation. When measured by computing power sold, these three Chinese companies command 95.4% of the global market share.

The Bitcoin ecosystem encompasses five primary segments: hardware supply, mining farm operations, mining pool management, trading platforms, and payment processing services.

Hardware manufacturers like Canaan, the first Bitcoin mining company to go public and the second-largest by computing power, focus exclusively on integrated circuit (IC) design, manufacturing, and equipment sales.

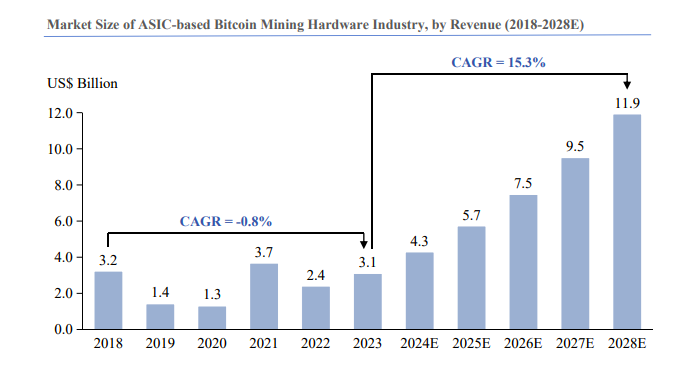

Industry analysts project continued sector expansion, with the market expected to reach $11.9 billion by 2028, representing a compound annual growth rate of 15.3%, contingent on Bitcoin’s continued price appreciation driven by supply scarcity.

China’s Historical Bitcoin Mining Advantage

Understanding today’s migration requires examining how China achieved such overwhelming market control in the first place.

The foundation was laid during the historic 2017 Bitcoin boom, when three key factors aligned to create Chinese mining supremacy.

During the early expansion phase, Chinese officials recognized cryptocurrency mining as a profitable venture that attracted substantial foreign investment.

Consequently, authorities initially overlooked the mining sector while simultaneously restricting Bitcoin trading and initial coin offerings.

China’s extensive hydroelectric infrastructure further strengthened the country’s mining operations, providing the cheap energy essential for profitable Bitcoin production.

Does Chinese Hardware Control America’s Bitcoin Network?

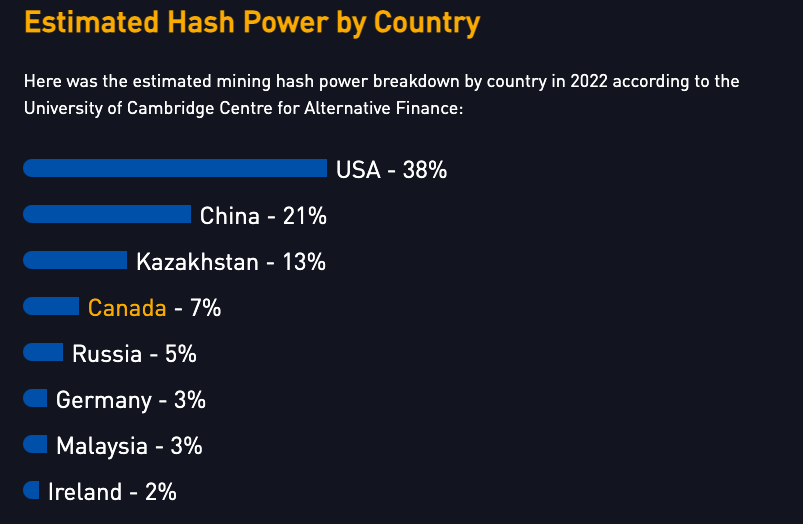

While the United States leads global Bitcoin mining operations with over 38% of total network activity, American miners depend almost entirely on Chinese-manufactured equipment.

This creates what security analysts describe as a “digital dependency trap,” a scenario where America’s cryptocurrency infrastructure relies fundamentally on hardware produced by its primary economic rival.

Guang Yang, Conflux Network’s chief technology officer, frames this dependency in geopolitical terms that extend far beyond trade economics.

“The U.S.-China trade war goes beyond tariffs,” Yang explains. “It’s a strategic pivot toward ‘politically acceptable’ hardware sources.”

His assessment reflects growing concerns within the cryptocurrency community about supply chain vulnerabilities that could impact national economic security.

Explore new destinations with ease using the Garmin Drive 52 GPS Navigator! With over 17,988 ratings and a solid 4.4/5-star rating, this GPS system has been a top choice for travelers. Over 500+ units were bought in the past month, all for only $144.99.

This 5″ GPS navigator comes with essential driver alerts, real-time travel data, and external memory storage. The simple on-screen menus and bright, easy-to-see maps make it easy to navigate wherever you are. Plus, it’s road trip-ready with The HISTORY Channel database, featuring notable historic sites and much more to enhance your journey.

Don’t miss out—get your hands on the Garmin Drive 52 today for a smoother ride ahead! Buy Now for $144.99 on Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

|

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

|

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

|

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.