Anas Hassan

2025-07-04 18:31:00

cryptonews.com

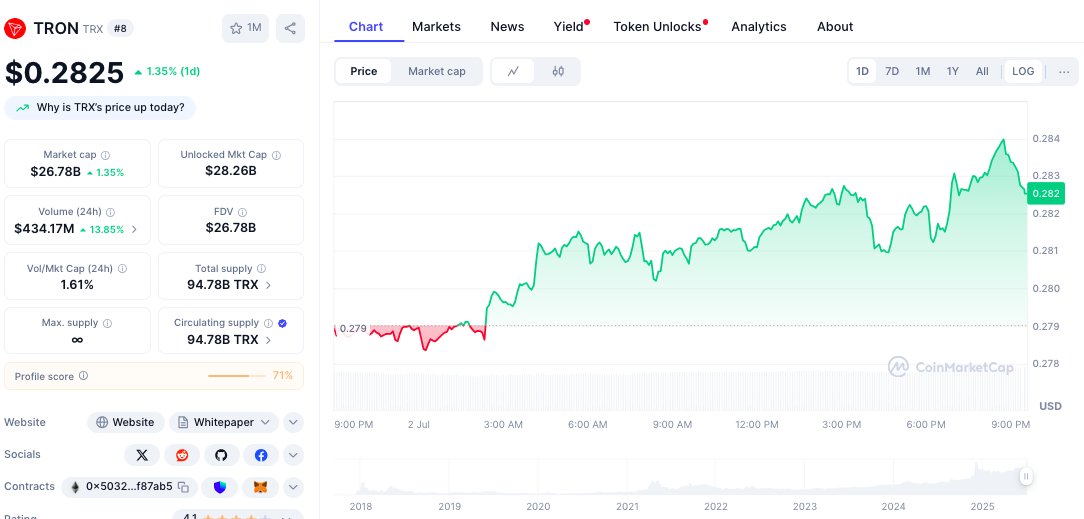

ChatGPT’s AI model processed 42 live indicators, revealing bullish momentum as TRON dips 1.07% to $0.2836, trading above all major EMAs.

Meanwhile, SRM Entertainment completes its historic $100 million TRX treasury launch, staking 365 million tokens with a 10% annual yield, targeting corporate balance sheet adoption.

A strong technical foundation emerges with the price above the 20-day ($0.2764), 50-day ($0.2671), 100-day ($0.2566), and 200-day ($0.2392) EMAs, as institutional treasury strategies drive unprecedented corporate adoption.

The market cap reaches $26.89 billion, with a steady daily volume of $477.09 million supporting structural consolidation momentum.

The following analysis synthesizes ChatGPT’s 42 real-time technical indicators, corporate treasury developments, institutional adoption metrics, and ecosystem growth data to assess TRX’s 90-day price trajectory amid the emerging altcoin treasury movement.

Technical Foundation: Bullish Structure Above All EMAs

TRON’s current price of $0.2834 reflects a decline of -1.25% from its opening price of $0.2870, establishing a tight trading range between $0.2880 (high) and $0.2812 (low). This controlled volatility demonstrates uptrend stability within established parameters.

RSI at 58.54 remains in healthy bullish territory, with substantial room for continued appreciation without concerns of overbought conditions.

MACD indicators show early bullish development, with the MACD line at 0.0008 trading above zero, confirming a positive momentum direction. The positive histogram at 0.0007 suggests building momentum acceleration, despite a slight signal line divergence.

The exceptional technical strength stems from its price positioning above all major EMAs, a rare bullish alignment that indicates a robust trend structure.

Trading above the 20-day EMA ($0.2752), 50-day EMA ($0.2709), 100-day EMA ($0.2623), and 200-day EMA ($0.2454) creates multiple support levels confirming sustained uptrend validity.

Corporate Treasury Shift: $100M TRX Staking Strategy

SRM Entertainment has achieved a major milestone, completing its $100 million TRON treasury launch by staking 365 million TRX tokens through the JustLend protocol, targeting an annual return of 10%.

The treasury strategy combines staking yields with energy rental income, creating diversified return streams that appeal to corporate treasury managers seeking yield enhancement. SRM is also rebranding to Tron Inc. with Justin Sun as an advisor.

SRM Entertainment’s unique business model extends beyond crypto, manufacturing souvenirs for Disney, Universal Studios, and Six Flags, demonstrating how mainstream corporations can integrate cryptocurrency treasury strategies.

The company’s $150 million market valuation, following a 13.5% stock surge, validates investor approval of crypto treasury adoption.

This development positions TRON alongside Ethereum, Solana, and XRP in the emerging altcoin treasury movement, where corporations diversify balance sheets beyond Bitcoin.

The 10% yield potential substantially exceeds traditional corporate cash management returns, driving institutional interest.

Historical Performance: Steady Recovery Building Momentum

TRON’s 2025 price action exhibits remarkable stability compared to the broader cryptocurrency market’s volatility. January-March saw consistent trading ranges of $0.25–$0.27, establishing a strong base for current appreciation.

April and May saw minor corrections to the $0.24–$0.25 levels, representing healthy consolidation that created accumulation opportunities without breaking the technical structure.

June’s recovery to a $0.27 closing price established momentum continuation patterns that support current technical positioning.

Current price action above $0.28 represents the extension of the established uptrend, with corporate treasury validation providing fundamental support for continued appreciation.

Support & Resistance: EMA Stack Provides Multiple Safety Nets

Immediate support emerges at today’s low around $0.2783, reinforced by the strong 20-day EMA support at $0.2752. This confluence creates an initial foundation for any short-term retracements during the current institutional positioning.

The exceptional support structure extends across multiple EMA levels, including the 50-day EMA at $0.2709, the 100-day EMA at $0.2623, and the 200-day EMA at $0.2454. This tiered support system provides multiple safety nets that appeal to risk-conscious institutional investors.

Resistance begins at today’s high around $0.2829, followed by the key psychological level at $0.2850–$0.2900. Breaking above this zone would indicate acceleration toward major psychological resistance at $0.3000–$0.3100.

Strong resistance emerges at previous range highs around $0.3900–$0.4000, representing the December 2024 all-time highs.

Stablecoin Infrastructure: USDT Dominance Drives Utility

TRON’s leadership in stablecoin settlements also creates sustainable demand drivers beyond speculative trading.

The network processes five times more USDT transactions than Ethereum, demonstrating superior efficiency for institutional settlement needs.

Daily transactions have nearly doubled since September 2023, indicating accelerating adoption across both retail and institutional segments.

Market Metrics: Steady Growth Supporting Corporate Adoption

TRON maintains a $26.7 billion market capitalization with moderate 1.35% market dominance, positioning TRX as an established infrastructure rather than a speculative altcoin. The $434.17 million daily trading volume provides adequate liquidity for institutional participation.

The circulating supply of 94.78 billion TRX represents a complete token distribution, eliminating concerns about supply overhang that affect other projects. This transparency appeals to corporate treasury managers requiring predictable tokenomics.

The volume-to-market cap ratio of 1.46% indicates healthy trading activity without excessive speculation.

Current pricing is 36% below December 2024 all-time highs, providing attractive entry points for institutional investors while maintaining substantial appreciation from 2017 lows.

LunarCrush data reveals strong community engagement with a Galaxy Score of 50, indicating positive sentiment momentum. The 86% positive sentiment reflects the community’s enthusiasm for corporate treasury developments and technical performance.

Social dominance of 0.6% with 337.94K total engagements demonstrates steady community interest without speculative excess. This balanced engagement profile supports sustainable appreciation rather than pump-and-dump patterns.

Recent social themes focus on corporate treasury adoption, Nasdaq milestone achievements, and technical breakout potential.

90-Day TRX Price Forecast

Corporate Treasury Expansion (Bull Case – 40% Probability)

Additional corporate treasury adoptions following SRM’s success could drive appreciation toward $0.35–$0.40, representing 24–42% upside. This scenario requires successful institutional onboarding and sustained yield generation from staking strategies.

Technical targets include $0.30 psychological resistance, followed by $0.35 and $0.40 based on historical levels. Corporate treasury momentum could attract additional institutional interest, creating sustained demand above speculative patterns.

Gradual Appreciation (Base Case – 45% Probability)

Continued steady growth within the current uptrend channels could target $0.32–$0.35 over the next 90 days. This scenario reflects sustained technical momentum, albeit without a dramatic acceleration in corporate adoption.

Support at the EMA structure between $0.2450 and $0.2750 would likely hold during normal consolidation periods. Volume maintaining current levels around 120–140 million TRX daily supports measured appreciation.

Technical Correction (Bear Case – 15% Probability)

Breaking below the 50-day EMA support at $0.2709 could trigger a correction toward $0.2450–$0.2600. This scenario would require broader market weakness or disappointments in corporate treasury strategy.

The strong EMA support structure limits downside risk, with the 200-day EMA at $0.2454 providing key long-term trend support.

TRX Forecast: Infrastructure Excellence Meets Corporate Validation

TRON’s positioning reflects the convergence of technical strength, corporate treasury validation, and infrastructure advantages in stablecoin settlements.

The 42-signal analysis reveals a cryptocurrency positioned for institutional adoption beyond speculative trading.

SRM Entertainment’s $100 million treasury launch sets a precedent for corporate TRX adoption through yield-generating strategies.

Technical indicators confirm a bullish structure, with the price above all major EMAs, while RSI positioning and positive MACD development suggest that momentum is building.

Current consolidation above $0.28, with corporate validation, creates optimal positioning for accelerated institutional adoption.

The combination of technical strength, yield generation potential, and infrastructure advantages positions TRX for sustained appreciation as corporate treasury strategies expand throughout 2025.

Last Updated: July 4, 2025. This article has been updated with the latest TRON market data, including current price action, percentage gains, key technical indicators, market capitalization, daily trading volume, and RSI levels to provide readers with the most current analysis.

Explore new destinations with ease using the Garmin Drive 52 GPS Navigator! With over 17,988 ratings and a solid 4.4/5-star rating, this GPS system has been a top choice for travelers. Over 500+ units were bought in the past month, all for only $144.99.

This 5″ GPS navigator comes with essential driver alerts, real-time travel data, and external memory storage. The simple on-screen menus and bright, easy-to-see maps make it easy to navigate wherever you are. Plus, it’s road trip-ready with The HISTORY Channel database, featuring notable historic sites and much more to enhance your journey.

Don’t miss out—get your hands on the Garmin Drive 52 today for a smoother ride ahead! Buy Now for $144.99 on Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

|

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

|

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

|

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![for Tesla Model 3 2025 Dashboard Cover,[Anti-Glare and Dustproof] Suede Dashboard Pad…](https://techcratic.com/wp-content/uploads/2025/08/61yHoBc6VfL._AC_SL1500_-360x180.jpg)