Julia Wendling

2025-07-16 11:47:00

www.visualcapitalist.com

The Case for Active ETFs

Active ETFs are funds managed with the goal of beating the market—and they’re rapidly reshaping the asset management industry.

In partnership with New York Life Investments, this visual breaks down why these instruments present a compelling opportunity for investors in today’s climate.

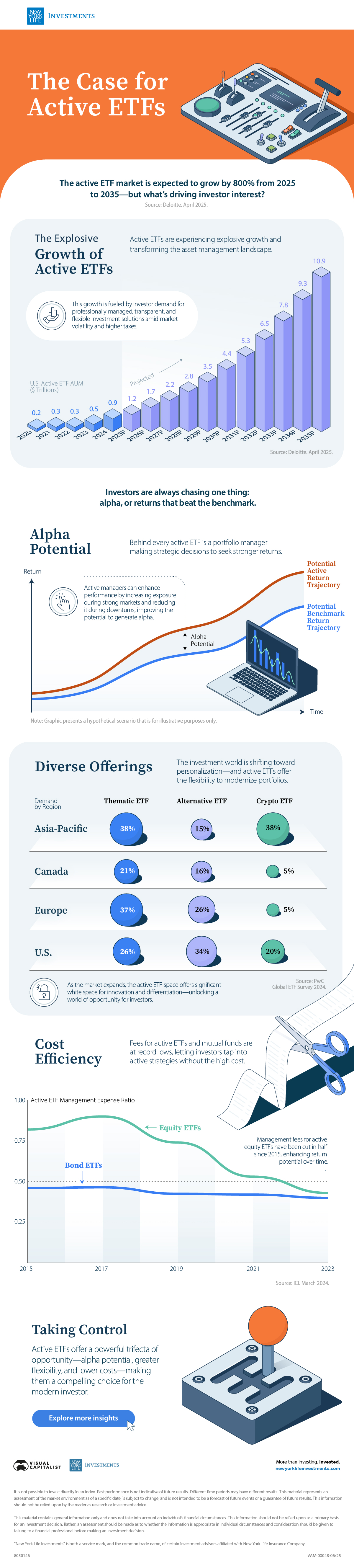

The Explosive Growth of Active ETFs

Active ETFs are booming in popularity. Investor demand for professionally managed, transparent, and flexible investment solutions amid market volatility and higher taxes is fueling this growth.

The active ETF market is expected to grow from $1.2 trillion in 2025 to $10.9 trillion in 2035. This marks 800% growth in just a decade.

| Year | U.S. Active ETF AUM ($ trillions) |

|---|---|

| 2020 | 0.2 |

| 2021 | 0.3 |

| 2022 | 0.3 |

| 2023 | 0.5 |

| 2024 | 0.9 |

| 2025F | 1.2 |

| 2026F | 1.7 |

| 2027F | 2.2 |

| 2028F | 2.8 |

| 2029F | 3.5 |

| 2030F | 4.4 |

| 2031F | 5.3 |

| 2032F | 6.5 |

| 2033F | 7.8 |

| 2034F | 9.3 |

| 2035F | 10.9 |

But investors are always chasing one thing: alpha, or returns that beat the benchmark. How might these instruments stack up?

Alpha Potential

Behind every active ETF is a portfolio manager making strategic decisions to pursue stronger returns. This flexibility allows them to boost exposure in strong markets and dial it back during downturns—enhancing the potential to generate alpha.

Diverse Offerings

The investment world is moving toward personalization, and actively managed ETFs provide the flexibility to modernize portfolios. As the market grows, they offer ample room for innovation and differentiation—opening up new opportunities for investors.

| Demand (%) | ||||

|---|---|---|---|---|

| Region | Thematic ETF | Alternative ETF | Crypto ETF | |

| Asia-Pacific | 38 | 15 | 38 | |

| Canada | 21 | 16 | 5 | |

| Europe | 37 | 26 | 5 | |

| U.S. | 26 | 34 | 20 | |

Active ETF investors can choose from a wide range of offerings, including popular thematic ETFs focused on areas like green tech, innovation, and reshoring. Cryptocurrency and alternative ETFs are also on the rise.

Cost Efficiency

Fees for actively managed ETFs and mutual funds are at record lows, letting investors tap into active strategies without the high cost. In fact, issuers have cut management fees for active equity ETFs in half since 2015, enhancing return potential over time.

| Active ETF Management Expense Ratio | ||

|---|---|---|

| Year | Equity ETFs | Bond ETFs |

| 2015 | 0.82 | 0.47 |

| 2017 | 0.90 | 0.48 |

| 2019 | 0.74 | 0.40 |

| 2021 | 0.53 | 0.39 |

| 2023 | 0.43 | 0.35 |

The management expense ratio (MER) for equity ETFs was 0.82 in 2015 versus 0.43 by 2023. Similarly, the MER of bond ETFs has been cut from 0.47 to 0.35 over the same timeframe.

Taking Control

These instruments offer a powerful trifecta of opportunity—alpha potential, greater flexibility, and lower costs—making them a compelling choice for the modern investor.

Explore more insights from New York Life Investments

var disqus_shortname = “visualcapitalist.disqus.com”;

var disqus_title = “The Case for Active ETFs”;

var disqus_url = “https://www.visualcapitalist.com/sp/the-case-for-active-etfs-nyl02/”;

var disqus_identifier = “visualcapitalist.disqus.com-179371”;

-

Economy2 months ago

Economy2 months agoCharting U.S. Trade Relationships

Maintaining a balanced perspective on trade is crucial. Which countries does the U.S. have the largest trade deficits and surpluses with?

-

Markets4 months ago

Markets4 months agoTrading Under Trump: Lessons from 2017-2021

With the second term of Trump underway, all eyes are on the markets to see how they react. Which sectors and regions that thrived last time?

-

Markets6 months ago

Markets6 months ago2024 in Review: Stock, Bond, and Real Estate Performance

How did equities, fixed income, and real estate (and their underlying sectors) perform in the U.S. throughout 2024?

-

Money9 months ago

Money9 months agoInvesting in an Era of an Aging Population

The U.S. population is aging. By 2070, the number of people over 65 will outnumber children. How can investors prepare?

-

Politics11 months ago

Politics11 months agoDoes it Matter to the Market Who Wins the White House?

After the president takes office, how have the market and the economy performed under Democrats vs Republicans?

-

Markets12 months ago

Markets12 months agoMagnificent 7 Mania: Why Diversification Still Matters

The Magnificent Seven stocks all outperformed the S&P 500 in 2023. However, it’s crucial to remember that diversifying a portfolio at both the company level and…

-

Markets1 year ago

Markets1 year agoWhat History Reveals About Interest Rate Cuts

How have previous cycles of interest rate cuts in the U.S. impacted the economy and financial markets?

-

Markets1 year ago

Markets1 year agoBeyond Big Names: The Case for Small- and Mid-Cap Stocks

Small- and mid-cap stocks have historically outperformed large caps. What are the opportunities and risks to consider?

-

Markets1 year ago

Markets1 year agoVisualizing the Record $6 Trillion in Cash on the Sidelines

Assets in money market funds are at all-time highs. But as investors stockpile cash, are they missing out on today’s stock market rally?

-

Markets2 years ago

Markets2 years agoWhat Drove Market Volatility in 2023?

Market volatility is often considered a gauge for investor fear. How did investors react as the economic climate evolved in 2023?

-

Markets2 years ago

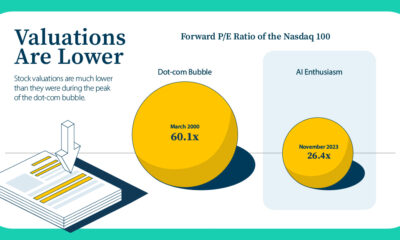

Markets2 years ago3 Reasons Why AI Enthusiasm Differs from the Dot-Com Bubble

Valuations are much lower than they were during the dot-com bubble, but what else sets the current AI enthusiasm apart?

-

Investor Education2 years ago

Investor Education2 years agoPaying Less Tax: The Tax-Loss Harvesting Advantage

Learn how tax-loss harvesting works by using capital losses to offset capital gains, potentially reducing your tax bill.

-

Markets2 years ago

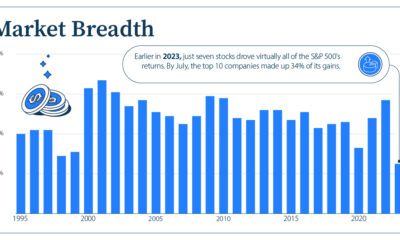

Markets2 years agoWhat’s Driving U.S. Stock Market Returns?

The performance of the S&P 500 has been strong so far in 2023. But what is fueling these stock market returns?

-

Markets2 years ago

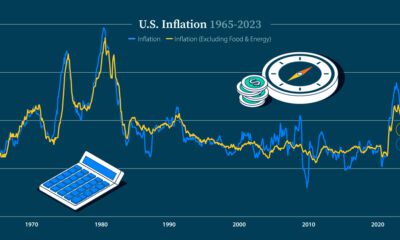

Markets2 years agoDecoding the Economics of a Soft Landing

Will the Federal Reserve achieve a soft landing? Here are key factors that play an important role in the direction of the U.S. economy.

-

Markets2 years ago

Markets2 years ago3 Reasons to Explore International Stocks Now

International stocks are trading at 20-year lows relative to U.S. stocks, which could present attractive buying opportunities for investors.

-

Markets2 years ago

Markets2 years agoFact or Fiction? Test Your Knowledge About Investing During a Recession

From sector performance to market recoveries, test your knowledge about investing during a recession with this interactive quiz.

-

Markets2 years ago

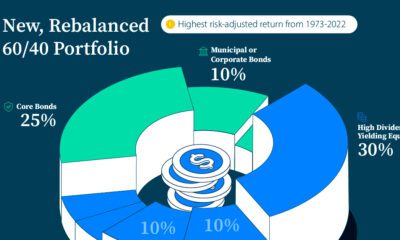

Markets2 years agoReimagining the 60/40 Portfolio for Today’s Market

Amid uncertain economic times, a new allocation for the 60/40 portfolio may help investors target higher risk-adjusted returns.

-

Markets2 years ago

Markets2 years agoThe Recession Playbook: Three Strategies for Investors

How can investors prepare for a market downturn? What goes into a recession investment strategy? We look at three sectors to consider.

-

Markets2 years ago

Markets2 years agoA Visual Guide to Bond Market Dynamics

What factors impact the bond market? Here’s how current interest rates, bond returns, and market volatility compare in a historical context.

-

Investor Education2 years ago

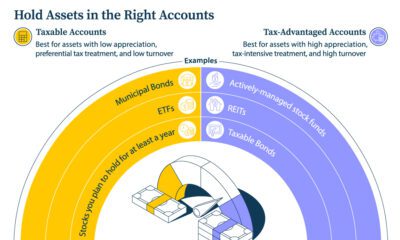

Investor Education2 years ago5 Tax Tips for Investors

Learn five tax tips that may help maximize the after-tax value of your investments, including which assets may be best for certain accounts.

-

Markets2 years ago

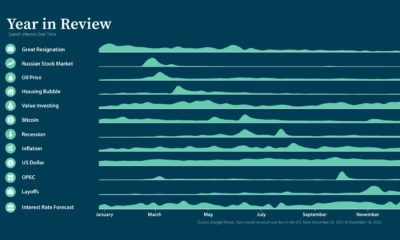

Markets2 years agoThe Top Google Searches Related to Investing in 2022

What was on investors’ minds in 2022? Discover the top Google searches and how the dominant trends played out in portfolios.

Keep your files stored safely and securely with the SanDisk 2TB Extreme Portable SSD. With over 69,505 ratings and an impressive 4.6 out of 5 stars, this product has been purchased over 8K+ times in the past month. At only $129.99, this Amazon’s Choice product is a must-have for secure file storage.

Help keep private content private with the included password protection featuring 256-bit AES hardware encryption. Order now for just $129.99 on Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

|

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

|

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

|

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.