Pallavi Rao

2025-07-28 08:12:00

www.visualcapitalist.com

Ranked: 50 Largest Companies in the World in 2025

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

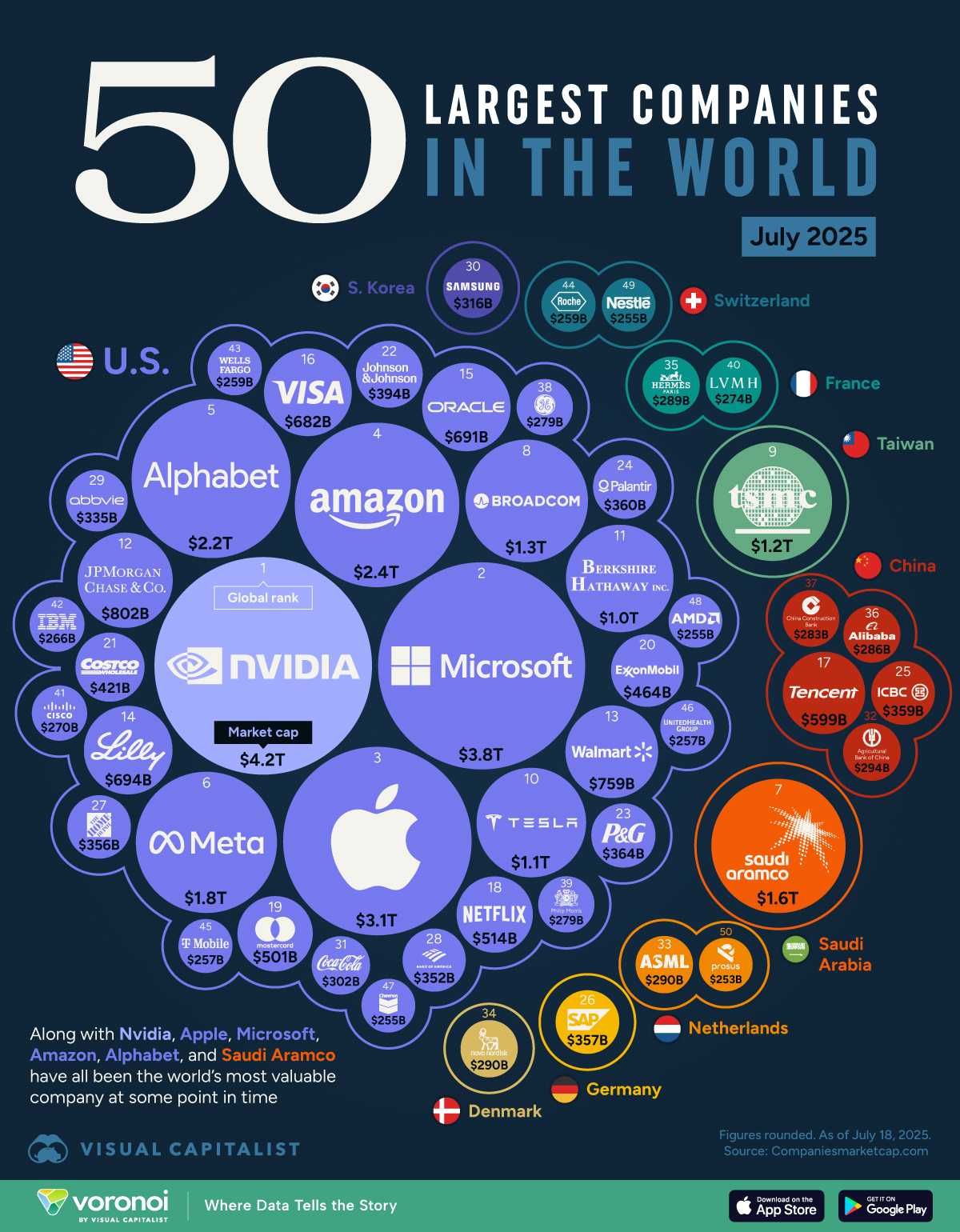

- Nvidia’s market capitalization has crossed $4 trillion, leading the world’s 50 most valuable companies in the world, as of July 18th, 2025.

- There are 34 American companies in the top 50.

- Saudi Aramco is the most valuable non-U.S. company, with a market cap of $1.6 trillion

For the first time ever, a pure-play chipmaker is the most valuable company in the world.

Nvidia’s blistering ascent puts it ahead of long-time titans Microsoft and Apple, and even state-owned oil behemoth Saudi Aramco.

The data for this visualization comes from CompaniesMarketCap.com. It captures the snapshot of listed firms by market value as of July 18, 2025, showing who rules the equity markets, and by how much.

The Most Valuable Company in the World

Nvidia now commands a $4.2 trillion valuation, more than the combined worth of Exxon Mobil, Saudi Aramco, and Chevron.

| Rank | Name | Country | Market Capitalization, July 18th, 2025 |

|---|---|---|---|

| 1 | NVIDIA | 🇺🇸 U.S. | $4.2T |

| 2 | Microsoft | 🇺🇸 U.S. | $3.8T |

| 3 | Apple | 🇺🇸 U.S. | $3.1T |

| 4 | Amazon | 🇺🇸 U.S. | $2.4T |

| 5 | Alphabet | 🇺🇸 U.S. | $2.2T |

| 6 | Meta Platforms | 🇺🇸 U.S. | $1.8T |

| 7 | Saudi Aramco | 🇸🇦 Saudi Arabia | $1.6T |

| 8 | Broadcom | 🇺🇸 U.S. | $1.3T |

| 9 | TSMC | 🇹🇼 Taiwan | $1.2T |

| 10 | Tesla | 🇺🇸 U.S. | $1.1T |

| 11 | Berkshire Hathaway | 🇺🇸 U.S. | $1.0T |

| 12 | JPMorgan Chase | 🇺🇸 U.S. | $801.5B |

| 13 | Walmart | 🇺🇸 U.S. | $759.3B |

| 14 | Eli Lilly | 🇺🇸 U.S. | $694.2B |

| 15 | Oracle | 🇺🇸 U.S. | $690.9B |

| 16 | Visa | 🇺🇸 U.S. | $681.5B |

| 17 | Tencent | 🇨🇳 China | $599.2B |

| 18 | Netflix | 🇺🇸 U.S. | $513.9B |

| 19 | Mastercard | 🇺🇸 U.S. | $500.9B |

| 20 | Exxon Mobil | 🇺🇸 U.S. | $464.3B |

| 21 | Costco | 🇺🇸 U.S. | $421.4B |

| 22 | Johnson & Johnson | 🇺🇸 U.S. | $394.4B |

| 23 | Procter & Gamble | 🇺🇸 U.S. | $363.7B |

| 24 | Palantir | 🇺🇸 U.S. | $360.1B |

| 25 | ICBC | 🇨🇳 China | $359.0B |

| 26 | SAP | 🇩🇪 Germany | $357.2B |

| 27 | Home Depot | 🇺🇸 U.S. | $356.3B |

| 28 | Bank of America | 🇺🇸 U.S. | $352.2B |

| 29 | AbbVie | 🇺🇸 U.S. | $334.7B |

| 30 | Samsung | 🇰🇷 South Korea | $316.1B |

| 31 | Coca-Cola | 🇺🇸 U.S. | $301.7B |

| 32 | Agricultural Bank of China | 🇨🇳 China | $293.7B |

| 33 | ASML | 🇳🇱 Netherlands | $290.2B |

| 34 | Novo Nordisk | 🇩🇰 Denmark | $289.7B |

| 35 | Hermès | 🇫🇷 France | $288.6B |

| 36 | Alibaba | 🇨🇳 China | $286.4B |

| 37 | China Construction Bank | 🇨🇳 China | $283.1B |

| 38 | General Electric | 🇺🇸 U.S. | $279.0B |

| 39 | Philip Morris International | 🇺🇸 U.S. | $278.7B |

| 40 | LVMH | 🇫🇷 France | $273.6B |

| 41 | Cisco | 🇺🇸 U.S. | $269.7B |

| 42 | IBM | 🇺🇸 U.S. | $265.8B |

| 43 | Wells Fargo | 🇺🇸 U.S. | $259.4B |

| 44 | Roche | 🇨🇭 Switzerland | $258.9B |

| 45 | T-Mobile US | 🇺🇸 U.S. | $257.3B |

| 46 | UnitedHealth | 🇺🇸 U.S. | $256.5B |

| 47 | Chevron | 🇺🇸 U.S. | $255.2B |

| 48 | AMD | 🇺🇸 U.S. | $255.1B |

| 49 | Nestlé | 🇨🇭 Switzerland | $254.9B |

| 50 | Prosus | 🇳🇱 Netherlands | $253.1B |

Investors are betting that generative AI will remain the most demanding workload in data centers for years, and Nvidia’s accelerators are still the go-to silicon solution.

However, Nvidia’s had a rocky ride in 2025. As recently as April, the company’s worth dropped to $2.3 trillion, but has since come roaring back. This Motley Fool opinion piece goes into why.

Briefly put, Nvidia’s stock has benefitted from two things:

- A general reduction in tariff uncertainties as trade deals began to sprout.

- A bumper earnings, where revenue essentially doubled YoY.

Meanwhile, Microsoft and Apple—who have been trading largest market cap back forth for the last few years—now trail the GPU pioneer for the first time.

America’s Dominance Grows Even Wider

U.S. firms make up 34 of the 50 most valuable companies in the world.

Big Tech sits comfortably in the top six slots, while stalwarts like Berkshire Hathaway and Walmart anchor the trillion- and near-trillion-dollar tiers.

Financial heavyweights JPMorgan Chase and Visa round out America’s footprint, showing that the country’s economic breadth—spanning chips, cloud, e-commerce, and consumer staples—remains unrivaled.

Combined, U.S. companies in the list exceed $30 trillion in market cap, dwarfing every other region.

Asia contributes eight names to the most valuable companies in the world, led by Taiwan’s TSMC at $1.2 trillion and China’s Tencent at just under $600 billion.

South Korea’s Samsung and a clutch of Chinese state-backed banks keep the region in the conversation. But only TSMC sits inside the global top 10.

Europe fields eight companies as well, with luxury houses Hermès and LVMH representing consumer demand, while Novo Nordisk and Roche highlight biotech strength.

Dutch lithography leader ASML remains critical to the semiconductor supply chain with a $290 billion valuation. Yet the continent’s absence from the trillion-dollar club underscores how digital platforms—and their outsized valuations—skew toward the United States.

Does Nvidia Deserve Its $4 Trillion Valuation?

On all other financial fundamentals, Nvidia is the smallest of the Big Tech companies.

Its FY25 revenue was $115 billion, an extraordinary doubling in the last year.

A quick reminder, however, that Apple nearly pulled in a profit of $100 billion two years ago.

So why is Nvidia picking up so much steam compared to its more established Big Tech peers?

Simply put: it’s a reflection of what investors think it can do in the future, not what it’s already done in the past.

Its chip business is seen as fundamental to the next wave of tech innovation, and there is a great deal of optimism for future growth capacity with growing demand for AI services.

However, this optimism brings elevated risk.

The valuation is justified only if Nvidia can maintain its current trajectory and successfully navigate competition, maturation of AI infrastructure, and potential regulatory headwinds.

Learn More on the Voronoi App

If you enjoyed today’s post, check out The $124 Trillion Global Stock Market by Sector on Voronoi, the new app from Visual Capitalist.

Keep track of your essentials with the Apple AirTag 4 Pack, the ultimate tracking solution for your belongings. With over 5,972 ratings and a stellar 4.7-star average, this product has quickly become a customer favorite. Over 10,000 units were purchased in the past month, solidifying its status as a highly rated Amazon Choice product.

For just $79.98, you can enjoy peace of mind knowing your items are always within reach. Order now for only $79.98 at Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

|

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

|

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

|

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.

![Mars Attacks! [DVD]](https://techcratic.com/wp-content/uploads/2025/07/81k3JO57X-L._SL1500_-360x180.jpg)