2025-03-25 08:54:00

www.techspot.com

By now, most of us are familiar with the fact that TSMC operates a significant amount of trailing edge manufacturing capacity. Long after they have moved on to ever more advanced nodes, they continue to run the older fabs.

Editor’s Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

In 2024, TSMC generated almost 50% of revenue from nodes that are five years or older – 7nm and up. This stands in contrast to Intel, which famously shut down old nodes when moving on to a new process. When Intel made the decision to do this, it made sense for their business model, but now that they are trying to enter the foundry business, that missing capacity is one more obstacle.

Still, we were curious as to just how profitable TSMC’s older nodes are. The company breaks out revenue by node, but very little beyond that. Armed with that and some guesswork learned estimates, we did some math.

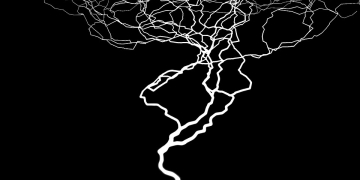

Below is a graph showing their 2024 revenue breakdown by node…

Revenue by Node

The advanced nodes – 3nm and 5nm combined – contribute 52%. By contrast, the chart below shows operating profit by node.

Operating Profit by Node

And for comparison here are the numbers…

| Node | Revenue | Op Profit |

|---|---|---|

| 3 nm | 18% | 13% |

| 5 nm | 34% | 14% |

| 7 nm | 17% | 27% |

| 18 nm | 8% | 12% |

| 20 nm | 0% | 0% |

| 28 nm | 7% | 10% |

| 40/45 nm | 4% | 6% |

| 65 nm | 4% | 6% |

| 90 nm | 1% | 2% |

| 110/130 nm | 2% | 3% |

| 150/180 nm | 4% | 6% |

| > 250 nm | 1% | 2% |

To put this in context, TSMC’s advanced nodes generate 52% of revenue but only 27% of profit. That being said, it is important to remember that the nodes – especially 3nm – are still in very early stages and are advancing in profitability quite rapidly.

The figures for 2023 actually show both 3nm and 5nm to be loss-making. They have made a lot of progress in recent years, and our estimate is that by next year, revenue share and profit share will align more closely. Just in time for a new node to launch.

A note on methodology:

We recognize that not everyone enjoys the intricacies of building models as much as we do. So we saved this portion for the end, for those who get it.

TSMC only breaks out revenue by node, not profitability or expenses, but that is enough to get started.

The big driver in this model is depreciation. The key to TSMC’s finances is that the old nodes are fully depreciated. The company depreciates equipment over five years. So 7nm, which launched in 2017, is the cutoff. Everything newer (3nm & 5nm) still carries depreciation load.

The company accounts for over 90% of its depreciation expense in Cost of Goods Sold (COGS). So, for our purposes, we allocated depreciation to the two advanced nodes by their share of revenue. Then we allocated the remaining COGS (minus depreciation) across all nodes by share of revenue. This is probably a little bit off – older wafers probably cost less and require fewer steps – but our sense is the difference is minimal.

We then looked at R&D. We assumed that the majority of R&D goes to the latest nodes, and again allocated the expense across 3nm and 5nm. This is actually a bit off, as our assumption is that the majority of R&D goes to nodes not yet in production.

However, we believe both the advanced nodes still incur a fair amount of R&D costs associated with working up the learning curve and improving yields (especially 3nm). So this overestimates costs to a degree, but to a degree we are comfortable with.

Finally, SG&A we allocated evenly across all nodes by their respective share of revenue. This probably overstates the costs of the older nodes, which presumably do not need as much management time or sales resources.

Keep your entertainment at your fingertips with the Amazon Fire TV Stick 4K! Enjoy streaming in 4K Ultra HD with access to top services like Netflix, Prime Video, Disney+, and more. With an easy-to-use interface and voice remote, it’s the ultimate streaming device, now at only $21.99 — that’s 56% off!

With a 4.7/5-star rating from 43,582 reviews and 10K+ bought in the past month, it’s a top choice for home entertainment! Buy Now for $21.99 on Amazon!

Help Power Techcratic’s Future – Scan To Support

If Techcratic’s content and insights have helped you, consider giving back by supporting the platform with crypto. Every contribution makes a difference, whether it’s for high-quality content, server maintenance, or future updates. Techcratic is constantly evolving, and your support helps drive that progress.

As a solo operator who wears all the hats, creating content, managing the tech, and running the site, your support allows me to stay focused on delivering valuable resources. Your support keeps everything running smoothly and enables me to continue creating the content you love. I’m deeply grateful for your support, it truly means the world to me! Thank you!

BITCOIN

bc1qlszw7elx2qahjwvaryh0tkgg8y68enw30gpvge Scan the QR code with your crypto wallet app |

DOGECOIN

D64GwvvYQxFXYyan3oQCrmWfidf6T3JpBA Scan the QR code with your crypto wallet app |

ETHEREUM

0xe9BC980DF3d985730dA827996B43E4A62CCBAA7a Scan the QR code with your crypto wallet app |

Please read the Privacy and Security Disclaimer on how Techcratic handles your support.

Disclaimer: As an Amazon Associate, Techcratic may earn from qualifying purchases.